Jul 25, 2022

Korea’s Economic Growth Accelerates as Consumption Rallies

, Bloomberg News

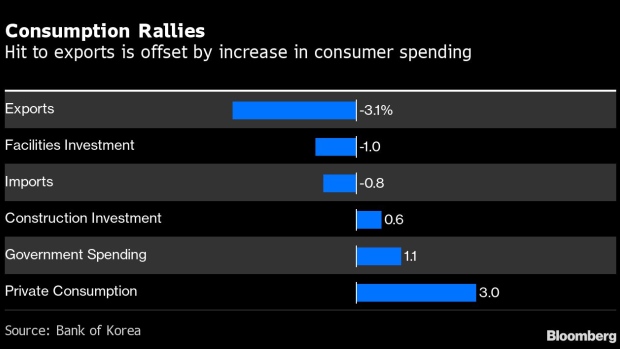

(Bloomberg) -- South Korea’s economic expansion accelerated last quarter as household and government spending helped absorb a hit to trade from intensifying inflation and Russia’s war on Ukraine.

Gross domestic product advanced 0.7% in the three months through June from the previous quarter, outpacing economists’ consensus for a 0.4% rise, Bank of Korea data showed Tuesday. From a year earlier, the economy gained 2.9%, also exceeding estimates.

South Koreans boosted spending as the country emerged from the grips of the omicron variant that weighed on the economy in the first three months of the year. Parliament also approved a record extra budget in May, providing support for small businesses, while keeping Covid regulations relaxed.

Still, exports in real terms declined as the trade-reliant economy came under pressure from rising energy and commodity prices fueled by Russia’s invasion of Ukraine. Exporters are also facing the risk of global demand waning in response to the Federal Reserve and other central banks rapidly tightening policy.

Covid lockdowns in China -- South Korea’s biggest export destination -- have also damped demand and exacerbated supply chain disruptions. Semiconductors, South Korea’s key export, have been piling up fast in inventories even as shipments have held up.

Domestic consumers face a challenging environment as inflation erodes their purchasing power and the Bank of Korea keeps raising rates, including its first-ever 50 basis-point move on July 13. The won has been Asia’s worst performer after the yen this year, making imports more expensive for households and manufacturers.

However, President Yoo Suk Yeol plans to be conservative when it comes to stimulus spending after South Korea’s debt swelled under his predecessor Moon Jae-in.

While the GDP performance can’t be considered the first full scorecard for Yoon, it does show the kind of economic momentum he has inherited and provides a yardstick for measures he needs to take.

Inflation is the key challenge for the administration, which took office in May, though it is also struggling to contain escalating labor disputes fueled by rising living costs and renewed Covid outbreaks.

Inflation topped 6% in June for the first time in more than two decades and is forecast to remain elevated this quarter. The BOK sees prices this year growing 4.5% -- more than double its 2% target -- while estimating the economy will expand 2.7%.

Resurgent Covid is a new challenge this quarter, even though the government is displaying confidence the outbreak can be brought under control without derailing the economy. The BOK is also concerned at the potential for a wage-inflation spiral.

The consensus for growth this year among private-sector economists fell to 2.6% this month. They also estimate a 25% chance of a recession within a year.

From the previous quarter, private consumption rose 3%, boosted by increased spending on clothes, shoes, entertainment and travel, according to the BOK.

Government spending advanced by 1.1% while investment in construction edged up 0.6%.

Exports declined 3.1%, with demand for chemical and metal products waning. Imports dropped 0.8% with crude and natural gas leading the decline. Facilities investment fell 1%, the central bank said.

(Adds breakdown from report.)

©2022 Bloomberg L.P.