Aug 25, 2023

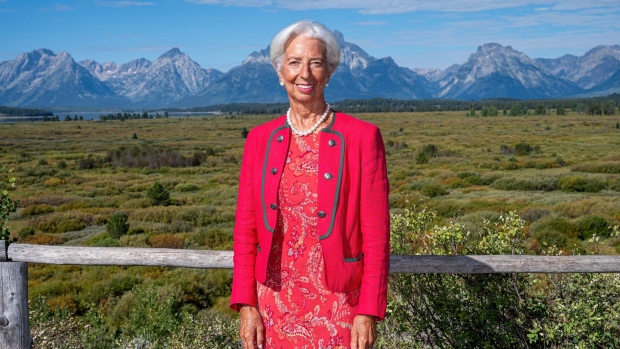

Lagarde Says ECB Rates to Be as High as Needed for Inflation

, Bloomberg News

(Bloomberg) -- President Christine Lagarde said the European Central Bank will set borrowing costs as high as needed and leave them there for as long as it takes to bring inflation back to its goal.

Describing an “era of uncertainty,” Lagarde said it’s important that central banks provide an anchor for the economy and ensure price stability in line with their respective mandates.

“In the current environment, this means — for the ECB — setting interest rates at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to our 2% medium-term target,” Lagarde said Friday in a speech in Jackson Hole, Wyoming.

The comments come at a pivotal time for the ECB and the 20-nation euro zone. Officials in Frankfurt are deciding whether to add one last hike to their unprecedented flurry of interest-rate increases, just as data signal that the economy may be succumbing to the recession it’s narrowly managed to dodge so far.

The euro traded steadily and was little changed against the dollar while European bond futures edged lower. With the cash market for sovereigns closed in Europe, bund futures slipped around 14 ticks while front-end schatz futures reached session lows.

In her first remarks at the Federal Reserve’s annual retreat since taking the helm of the ECB in 2019, Lagarde didn’t add to earlier guidance that next month’s rate meeting will bring either a 10th consecutive increase or a pause.

The ECB chief and her colleagues, though, are awaiting crucial price data and a fresh set of economic projections before that Sept. 14 decision. While inflation is firmly on the wane from last year’s double-digit peak, officials remain on alert about underling pressures that exclude things like food and energy costs and which are proving more unyielding.

A softer economic backdrop may help bring core inflation down — and that’s certainly the scenario the euro region is facing. The bloc may see output contract this quarter as the services sector follows manufacturing into a downturn, a business survey showed this week.

The problems are most acute in Germany. Europe’s largest economy only managed to stagnate in the second quarter following a recession over the preceding six months, and sentiment is worsening.

Lagarde reiterated that future ECB decisions will hinge on the inflation outlook, the dynamics of core price growth and the strength of monetary-policy transmission.

“These three criteria help mitigate the uncertainty surrounding the medium-term outlook by blending together our staff’s inflation projections, the trend that we can extract from underlying inflation, and the effectiveness of our policy measures in countering that trend,” she said.

The debate over the ECB’s next steps is gathering pace. Bundesbank President Joachim Nagel told Bloomberg TV this week that with inflation above 5%, it’s premature to consider a pause in rate hikes.

Latvia’s Martins Kazaks offered a similar view, saying he’d err on the side of raising rates and that officials can always cut if needed.

His Portuguese counterpart, Mario Centeno, however, urged caution as downside risks to the economy materialize.

Jackson Hole has often been used by central bankers as a stage for major policy pronouncements. Last year, officials including Fed Chair Jay Powell and ECB Executive Board member Isabel Schnabel set the tone for a prolonged assault on inflation.

Lagarde’s restraint on laying out a clear path for the coming months contrasts with her predecessor, Mario Draghi. His 2014 speech at the event put the ECB on course to embark on quantitative easing the following year.

--With assistance from Edward Bolingbroke and Carter Johnson.

(Updates with market reaction in fifth paragraph.)

©2023 Bloomberg L.P.