Apr 5, 2021

Larry Berman: S&P 500 earnings expectations rise into sell-in-May rally

By Larry Berman

Larry Berman: Earnings per share estimates rise

Optimism around market performance, corporate earnings and economic recovery could be setting the tables for a traditional May sell-off.

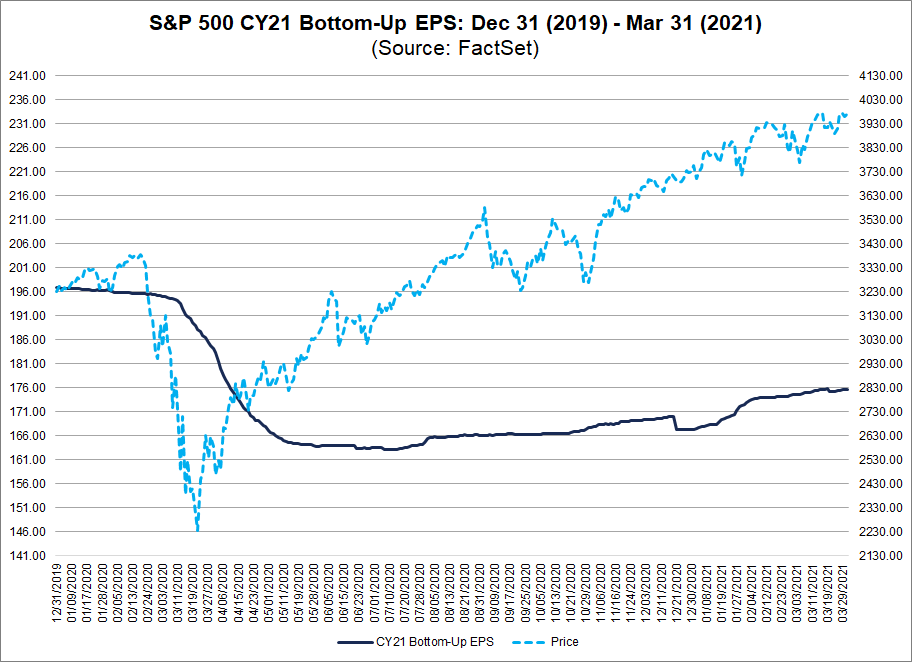

Bottom-up estimate expectations for 2021 were about US$164, according to S&P Global at the start of the year. Bloomberg consensus had similar numbers. FactSet, had the number at US$167 to start the year. They are currently at US$176. The current numbers for 2022 are about US$200. I think a 20-times multiple is expensive, compared to the historic mean 16.5-times, which gives the S&P 500 a 4,000 target at the end of 2022. If bond yields rise 100 basis points and “normalize,” as the U.S. Federal Reserve seems to want with more inflation, the multiple should be closer to 18-times, which would put the market at 3,600 at the end of 2022. Herein lies the major challenge we face: Bond yields need to stay very low to keep the elevated multiple in the 22-to-23-times range, which would put the upside range of the S&P 500 in the 4,400-to-4,600 by the end of 2022.

At the end of 2019, the expectation for 2021 earnings was in the US$200 range (per the below chart). The S&P 500 was at 3,230 and the U.S. 10-year bond was at 1.92 per cent. Now, this was all pre-pandemic. The S&P 500 is now at 4,020 and the 10-year currently sits at 1.72 per cent. It seems like stocks are very expensive relative to bonds in this simple analysis. It probably does not matter for the next four-to-six weeks of good news during earnings season and vaccine re-opening rollouts, but this could be setting up a “Sell in May” rally.

U.S. banks kick off big cap earnings on April 14. The banks have been the biggest beneficiary of the steepening yield curve, so it will be important to hear how the financial institutions are faring on loan losses and net interest margins. I expect lots of good news from the banks. The steeper yield curve has been a big positive. In wanting higher inflation, the Fed wants a steeper yield curve. They will have to have yield-curve control to keep it.

It will be tough to form comparisons on the consumer side of earnings for a while given non-conventional pandemic spending patterns. But the hopes for re-openings, will likely keep the news there good as well.

Big Tech reports closer to month’s end and the news there will likely be good, too, save supply shortages. I’m very concerned that once all that good news gets reflected in the higher multiple, all the debt will need to be financed in the coming year. I also worry what that means for interest rates. An estimated net deficit of over US$2 trillion (based on Treasury needs weighed against Fed buying) will need to be funded. The biggest buyer will need to be the Federal Reserve. They know it. They just do not want to talk about it. This will be a problem at some point in the second half of the year. Keep this on your radar.

This week in our weekly Thursday Spring 2021 Berman’s Call virtual roadshow we will focus on earnings and valuation and how that fits into our analysis of markets and ETFs. Register at www.etfcm.com or at www.investorsguidetothriving.com. The format this series will be a 30-40 minute weekly presentation that changes each week to current market developments and a 30-40 minute Q&A.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com