Sep 18, 2023

Larry Berman: What to expect from U.S. economic projections

By Larry Berman

This week, the U.S. Federal Open Market Committee (FOMC) will introduce their new, detailed summary of economic projections, also known as “dot plot.”

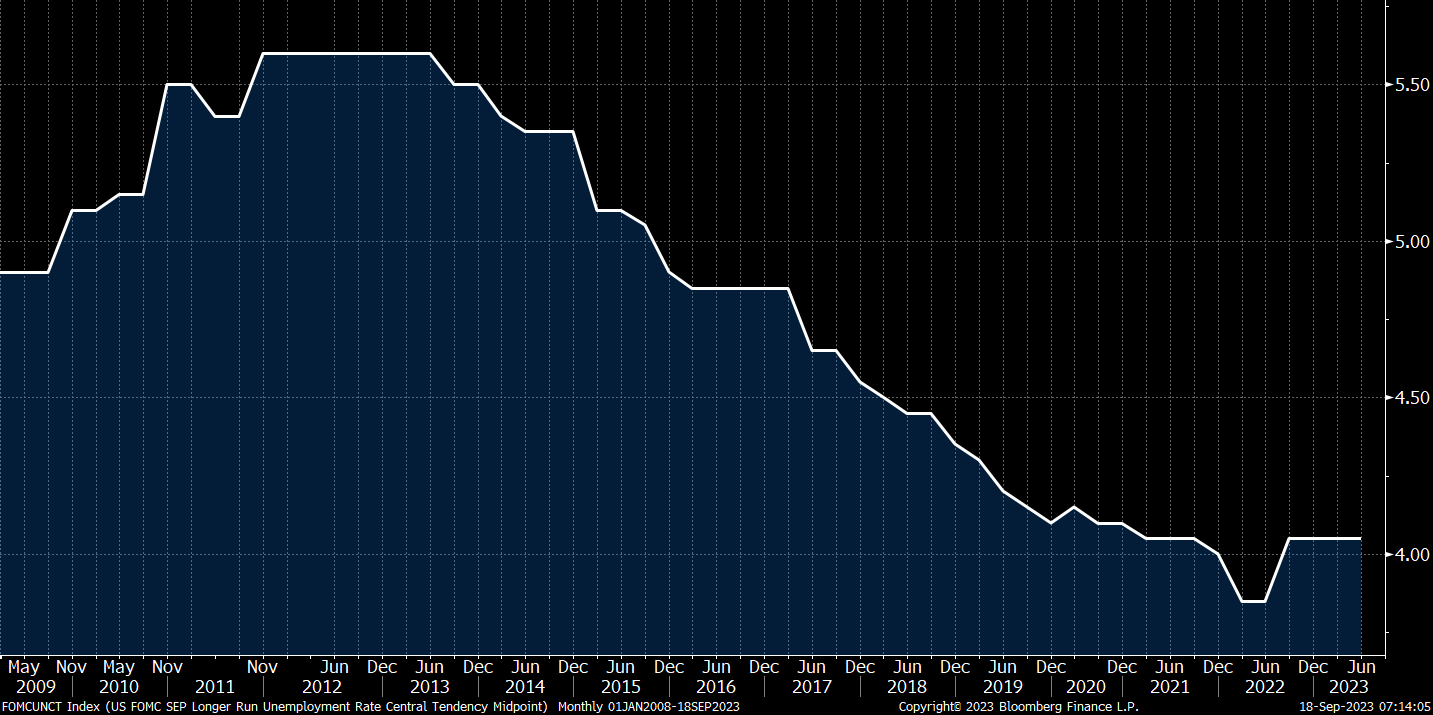

Of particular importance is their expectation for unemployment. The non-accelerating inflation rate of unemployment (NAIRU) has to be their main focus. The labour market is still very strong, we are seeing very high profile strikes by autoworkers and we are on the cusp of a federal employee budget debate shutdown.

U.S. Federal Reserve Chair Jerome Powell has talked about some pain coming for Main Street and thus far, we have not seen any pain at all. Recently, Federal Reserve researchers have moved off the hard landing scenario, so we would not expect a reversal here just yet, but that would be the place where the market gets the biggest surprise, given it’s still priced for perfection.

Market-based pricing suggests that most market participants believe that a soft landing is the likeliest future scenario. Most strategists are moving price targets higher, as any predicted slowdown has been pushed out by surprisingly strong labour demand. Many argue that a market correction of 10 per cent is highly likely first. We do not believe the business cycle has changed. The end of every cycle of rate hikes ends in an economic downturn. We should not expect this time to be different.

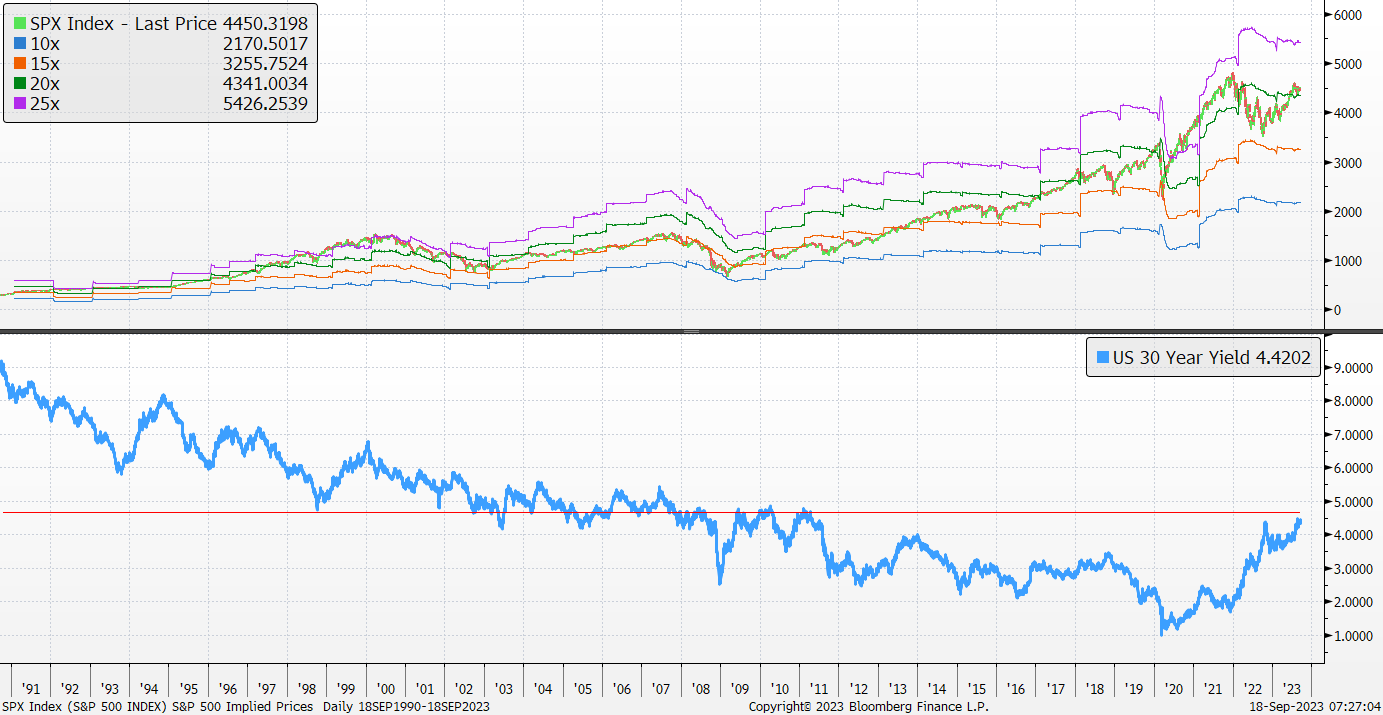

When it comes to equity market valuation, forward-based earnings expectations (EPS) are showing only a very modest decline over the next year. This would be a soft landing scenario. But in a soft landing scenario, why should we be expecting FOMC rate cuts? Our long-term chart of forward-based EPS at various multiples is compared to the long-term U.S. treasury rate. Over the past 30 years, the median rate is around 4.75 per cent. The last long-term period of time (2002 to 2010) where long bond yields were in this range, the average forward multiple was closer to 15 times EPS on average, versus the current level of above 20 times. If “higher for longer” is the message out of the FOMC this week, which we expect, and quantitative tightening and massive deficits are still a major headwind for valuations, we should see the market trade back towards the 15 times multiple before the current business cycle bottoms.

The FOMC will not likely risk reigniting inflation by stimulating without a hard landing scenario playing out. Expect them to reiterate their data dependancy, and for markets to struggle going forward in a “higher for longer” narrative. We’d be surprised if there was anything dovish out of the meeting this week. I think they are done raising rates, but they cannot signal that until there is a significant weakness in the economy and weakness in labour markets in particular. That seems like a 2024 story at this point.

The FOMC will not likely risk reigniting inflation by stimulating without a hard landing scenario playing out. Expect them to reiterate their data dependancy, and for markets to struggle going forward in a “higher for longer” narrative. We’d be surprised if there was anything dovish out of the meeting this week. I think they are done raising rates, but they cannot signal that until there is a significant weakness in the economy and weakness in labour markets in particular. That seems like a 2024 story at this point.

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman