Nov 26, 2018

Microsoft vies again with Apple for No. 1 in global market value

, Bloomberg News

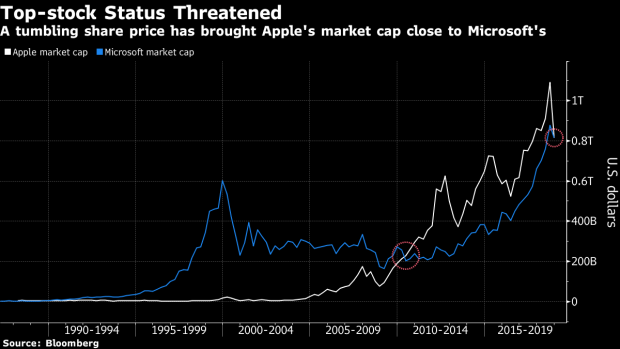

Apple Inc. gave up its crown as the world’s most valuable publicly traded company, at least for a few minutes Monday.

A steep decline in the iPhone maker’s share price over the past several weeks briefly took its market valuation slightly below fellow technology bellwether Microsoft Corp.’s on Monday for the first time in more than eight years.

Apple’s market valuation of US$812.60 billion dipped below Microsoft’s US$812.93 billion as of 1:05 p.m. in New York, meaning it had shed about US$300 billion in value after cresting a record US$1.1 trillion valuation in early October. Yet the technology behemoths continued to jockey for the top seat in intraday trading. The last time Microsoft was bigger than Apple based on market cap was in mid-2010, according to data compiled by Bloomberg.

Apple has slid amid growing concerns the company is seeing weak demand for iPhones, by far its biggest product line. Shares have fallen more than 25 per cent from record levels. While Microsoft hasn’t been immune from weakness in the technology sector, it has held up much better, falling just 9 per cent from its own all-time high.

Shares of Apple fell 0.7 per cent on Monday, while Microsoft rose as 2.1 per cent.

According to Rich Ross, a technical analyst at Evercore ISI, Apple’s stock “has another 18 per cent downside,” which could take the stock to US$140. “It is not bullish when the biggest stock in the world is in ‘falling knife’ mode,” he wrote to clients on Monday.