Jan 31, 2024

New Zealand House Prices Rise at Slower Pace, CoreLogic Says

, Bloomberg News

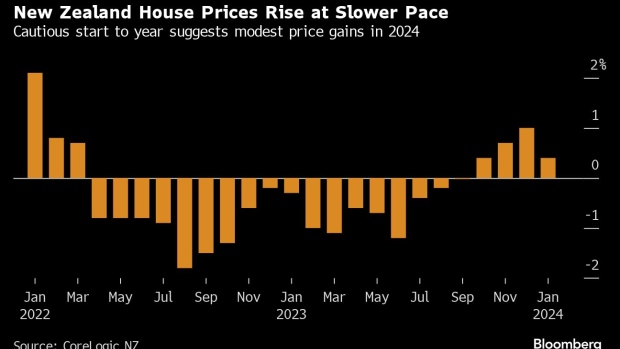

(Bloomberg) -- New Zealand house prices rose at a slower pace in January, adding to signs of a tentative recovery that may mean only modest gains in 2024, according to CoreLogic.

Values rose 0.4% from December, when they climbed 1%, the company said Thursday in Wellington. From a year earlier, prices fell 2.7% compared to a 3.3% annual decline in the previous month.

While prices have gained for four straight months, the deceleration in January suggests buyers remain wary of high borrowing costs amid expectations the Reserve Bank won’t start loosening monetary policy until later in 2024. The central bank this week doused speculation it may be preparing to pivot toward rate cuts any time soon.

“Even though most indicators are pointing up, there’s still the challenge of high mortgage rates to contend with, both for new borrowers and those repricing existing loans,” said Kelvin Davidson, chief property economist at CoreLogic. “There’s now a whiff of Official Cash Rate cuts on the horizon, but that’s probably a story for the second half of 2024, not the first.”

RBNZ Chief Economist Paul Conway said Tuesday policymakers “still have a way to go” to get inflation back to the midpoint of the 1-3% target band. In November, the central bank indicated it wouldn’t cut rates until 2025 although most economists expect the easing to begin in the second half of this year.

ANZ Bank this week said it no longer expects house-price gains in the first half of the year, citing the large number of homes on the market and sluggish sales. Values will rise in the second half as mortgage interest rates start falling but will increase just 2% this year, down from the previous projection of 4%, the lender said.

CoreLogic expects sales volumes and prices to track higher in 2024 but with variability from month to month, Davidson said. Strong immigration flows will support demand, particularly in the largest cities, he said.

The average house price rose to NZ$928,184 ($569,000), according to CoreLogic data. Prices gained from a month earlier in all six of the nation’s biggest urban areas.

©2024 Bloomberg L.P.