Feb 17, 2019

Oil rally finally pulls hedge fund optimists off the sidelines

, Bloomberg News

Oil optimists look like they’re finally ready to take the driver’s seat in crude’s rebound.

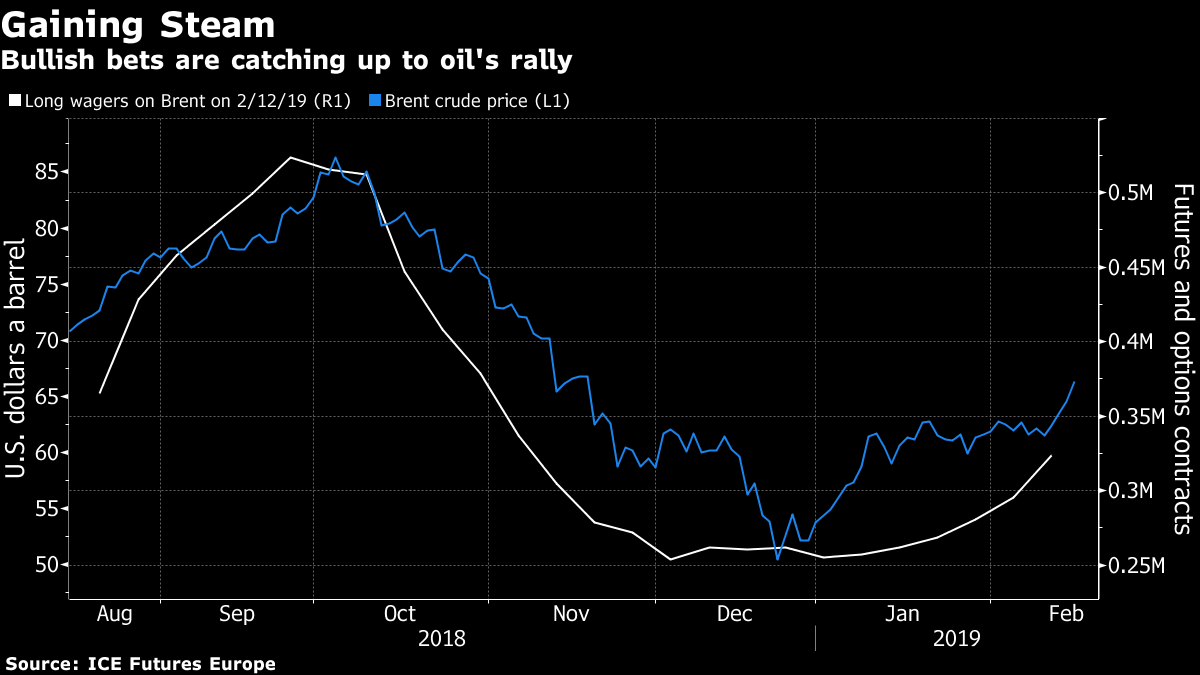

For the first time this year, a jump in bets that Brent crude prices will rise far surpassed the move by short sellers, helping set the tone for money managers’ positioning on the global benchmark. Sentiment is now the most bullish since late October.

So far, the mood had hinged mostly on what short-sellers were up to. But in the week ended Feb. 12, bullish bets rose by 10 per cent, the most since late August, according to data released Friday. Wagers on falling prices shrank by 5.5 per cent

“Many of the worries we’ve had about demand have dissipated," said Bart Melek, head commodities strategist at TD Securities in Toronto, said in an interview. “That’s convinced people to strap on some risk again."

After surging 15 per cent in January’s first 10 days, Brent slipped into neutral for more than a month, weighed down by worries over the U.S.-China trade war and record U.S. production. The rally reignited last week after Saudi Arabia and Russia both pledged to expand cuts to their crude output. The S&P 500 joined in, hitting a 10-week high on Friday after reports American and Chinese negotiators had reached a consensus.

Brent closed at US$66.25 a barrel on Friday and gained almost seven per cent for the week, more than in the previous four weeks combined. West Texas Intermediate, meanwhile, set a new high for 2019, closing at US$55.59 in New York.

With mounting signs of production cuts by OPEC and other top exporters, crude shrugged off more pessimistic signs, including surprisingly weak retail sales and a dip in refinery activity in the U.S. That was partly due to “speculators pushing the upside," said Bob Yawger, director of futures at Mizuho Securities USA.

Net-longs — the difference between bullish and bearish bets on Brent — climbed 14 per cent to 266,057 futures and options for the week ended Feb. 12, the ICE Futures Europe exchange said on Friday.

Last week’s gains may convince computer-driven traders who make up about a third of the market to liquidate even more of their short bets, said TD’s Melek. Brent passed a series of price thresholds that, based on an analysis of past trading, are likely to trigger more aggressive moves ahead, the strategist said in a note to clients Friday.

The latest information on WTI positioning won’t be available until next month, as the U.S. Commodity Futures Trading Commission is still releasing older data following the government shutdown.