Dec 20, 2022

Oil rises in a low volume session bolstered by softer dollar

, Bloomberg News

Oil Markets Seeing 'Soft Patch,' BofA's Blanch Says

Oil rose in a session marked by waning liquidity ahead of the holiday season, supported by a softer dollar and a potential boost in energy demand after China abandoned its COVID Zero policy.

West Texas Intermediate settled above US$76 a barrel after flip-flopping much of the session, aided by a weaker dollar, which makes commodities priced in the currency more attractive. China’s efforts to revive its economy by removing harsh virus curbs is spurring hopes of higher consumption in the long term.

Continued supply disruptions in the U.S. are also supporting oil. TC Energy pushed back its targeted restart for the Keystone pipeline by a week and is now aiming for December 28 or 29, according to people familiar with the batter. Elsewhere, output in North Dakota has fallen by about 300,000 barrels a day since a winter storm last week and the recovery will take some time.

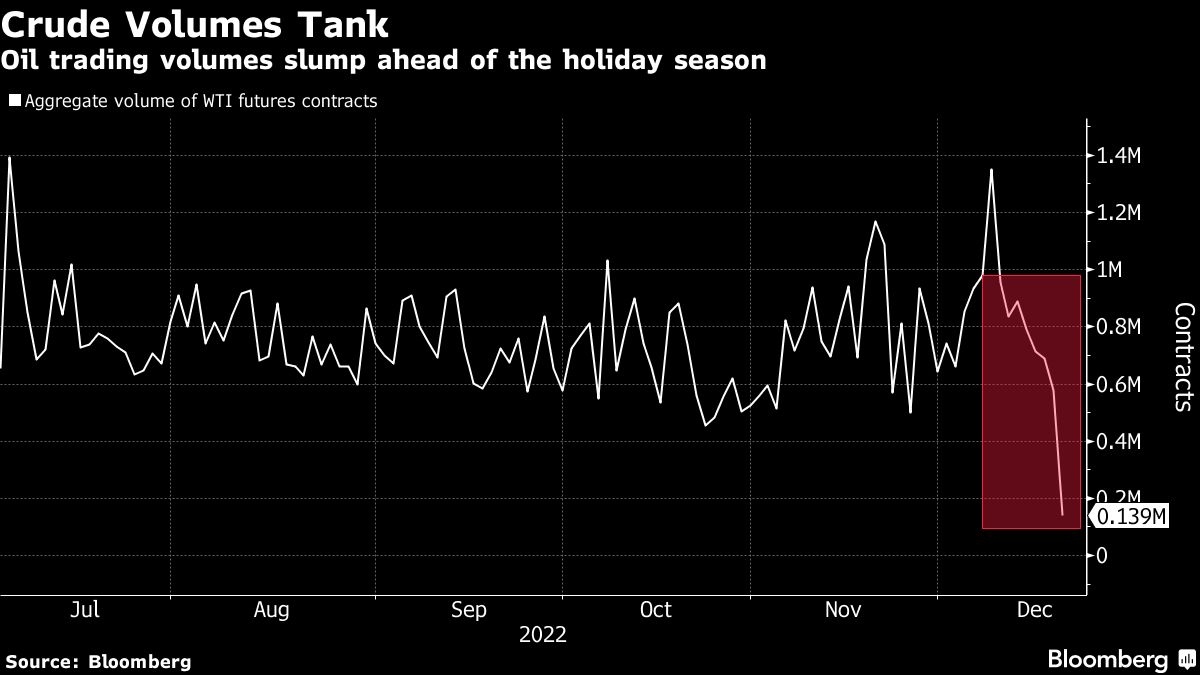

Crude is still on track for a second monthly loss with a persistent lack of liquidity leaving prices prone to large swings. The U.S. Federal Reserve is continuing with aggressive interest-rate hikes, while a top European Central Bank official said it would take time for inflation to be brought down.

The Saudi oil minister reminded oil market participants that OPEC+ can and will continue to make decisions based on how it views market conditions and can pivot accordingly. OPEC and its allies have no choice but to remain pro-active and preemptive given the uncertainties that face the market, Abdulaziz bin Salman bin Abdulaziz Al Saud said.

Prices:

- WTI for February delivery rose 85 cents to settle at US$76.23 in New York.

- The January contract, which expires Tuesday, rose 90 cents to settle at US$76.09.

- Brent for February rose 19 cents to settle at US$79.99 a barrel.