Apr 4, 2023

OPEC+ Cut Set to Trigger More Competition for Latin America Oil

, Bloomberg News

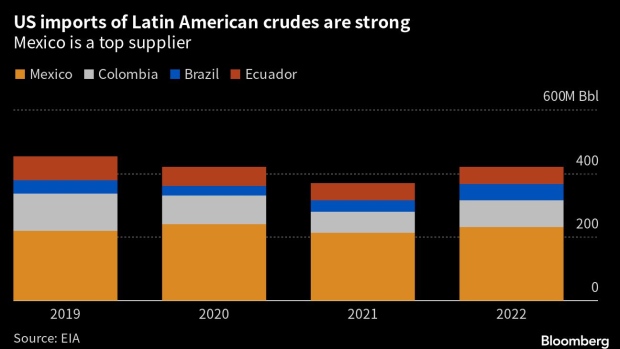

(Bloomberg) -- A shock move by OPEC and its allies to cut their mainly high-sulfur crude output is about to thrust Latin America into the spotlight as a possible source of replacements.

This could turn into a battleground for US refiners wanting to keep outsiders away from those supplies just as they gear up for North America’s high-demand summer season. American buyers have for years cultivated supply lines across the Americas while large OPEC producers like Saudi Arabia steered the bulk of their oil to Asia — a region that offers the Kingdom the most profitable returns.

Competition could come when Asian refiners have already been actively purchasing heavy crudes from South America and Canada, boosting their prices. But there might not be enough to go around. Canadian barrels have been limited by seasonal maintenance and Latin American supply won’t be enough to counter the announced cuts from the Organization of Petroleum Exporting Countries alliance. That could propel heavy oil prices even higher, spurring fuel inflation.

Read More: Chinese Mega-Refinery Lifts Heavy Oil Prices From the Doldrums

“US buyers will fight to keep Latin American and Gulf of Mexico sour crudes at home, particularly as Middle East flows to the US continue to dry up,” said Matt Smith, lead Americas oil analyst for industry consultants Kpler. He added that Latin America exports more medium and heavy sour crude than the US produces in the Gulf of Mexico — making the South’s producers invaluable.

©2023 Bloomberg L.P.