Apr 3, 2024

Peel Hunt Says UK Small-Cap Stock Index on Track for Extinction

, Bloomberg News

(Bloomberg) -- An index of UK small-cap stocks will cease to exist by 2028 if the current level of takeover activity persists and the initial public offering market fails to rebound, London stockbroker Peel Hunt Ltd warned.

The number of companies listed on the FTSE Small Cap Index, excluding investment trusts, fell to 114 at the end of 2023 from 160 at the end of 2018, Peel Hunt Head of Research Charles Hall said in a note to clients.

“The pace of de-equitization is relentless,” Hall said.

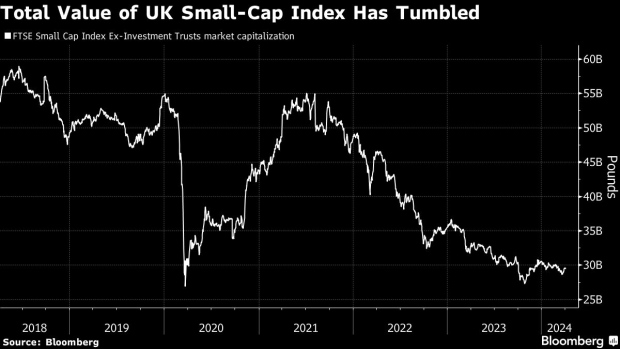

Firms on the small-cap index had a combined market capitalization of just £29.4 billion ($37.0 billion) as of Tuesday’s close, barely half of its 2018 peak of about £57 billion, data compiled by Bloomberg shows.

The slump has been partly driven by takeovers as beaten-down valuations entice bidders, and the trend has continued this year. Twelve British companies with a value of more than £100 million received buyout offers in the first quarter of 2024 alone, Peel said.

Meanwhile, new additions to the market have been minimal. Companies raised just £817 million on the London Stock Exchange in 2023, the least since 2009, according to data compiled by Bloomberg.

The UK capital’s listing woes have not been limited to the small-caps. Larger firms including Ferguson Plc and CRH Plc have shifted their primary listings to New York as they hunt for higher valuations. Analysts at Deutsche Bank AG on Tuesday predicted that mining company Glencore Plc could be the next big company to reconsider its UK listing.

Peel Hunt, meanwhile, called for additional measures to improve fund flows into the UK market, including addressing the country’s “penal” stamp duty. The note was published on the same day that Peel Hunt said it expects to report a loss for the full year. The company’s shares fell as much as 6.7%.

A spokeswoman for London Stock Exchange Group Plc, owner of index-calculator FTSE Russell, declined to comment.

--With assistance from James Cone.

©2024 Bloomberg L.P.