Dec 7, 2023

RBC becomes no. 2 U.S. municipal underwriter

, Bloomberg News

It's a mixed result to see such a discrepancy between TD, RBC and CIBC earnings: Thackray

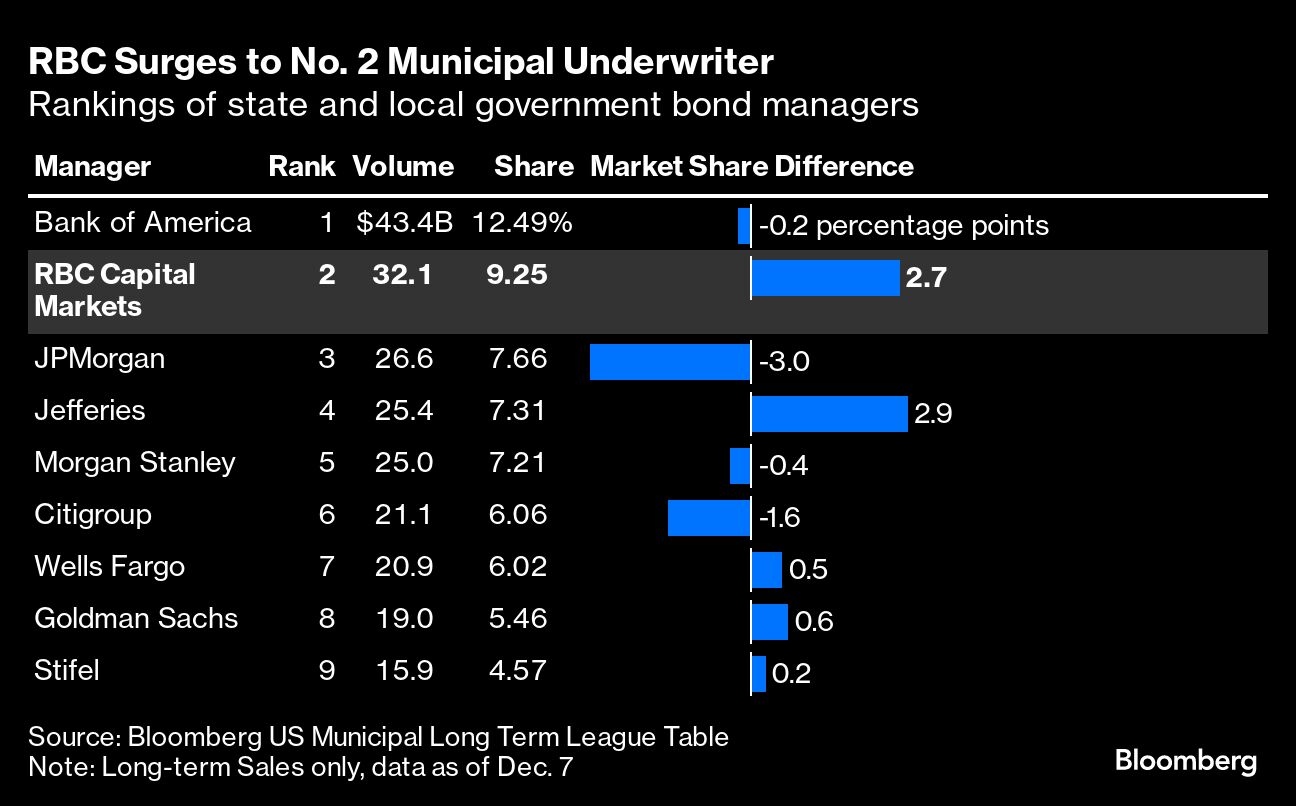

RBC Capital Markets is having its best year on record, propelling the Canadian bank to become the No. 2 underwriter of U.S. state and local debt.

Its public finance team led by Bob Spangler has risen three spots this year on Bloomberg’s ranking of underwriters to its highest position ever and the best U.S. performance of a foreign bank. The top slots have been historically reserved for American behemoths including Bank of America Corp., JPMorgan Chase & Co. and Citigroup Inc.

RBC has been credited with managing over US$32 billion of long-term municipal bonds this year, amounting to more than nine per cent of overall sales, according to data compiled by Bloomberg. That’s up 2.7 percentage points from last year, one of the largest gains of any bank, the data shows.

“All of our sector practices outperformed and that allowed us to really rise up in the marketplace,” Spangler, head of municipal finance, said in an interview.

“What we do well in the market has done well this year,” said Spangler, noting that RBC has long dominated in sectors that have outperformed: housing, health care, public power and higher education.

For instance, RBC continues to command in so-called prepaid gas contract bond sales that help utilities get a discount on fuel costs, a large niche in the municipal-bond market. Those types of deals tend to be hundreds of millions of dollars, and this year has seen record issuance.

Other large banks haven’t had such a positive 2023 as they cull senior staff and see declining market share amid the elevated interest-rate environment. Muni bond issuance was lackluster in 2023 and 2022 due to higher rates. UBS Group AG announced in October it would exit a key part of the underwriting business. And Bloomberg reported in November that executives at Citigroup considered cutting the department to reduce costs.

The upheaval has given some banks like RBC a chance to lure top talent.

“I’ve seen a lot of people with resumes coming across my inbox,” said Spangler. He said his team is still looking to add new hires where it can, such as for the health-care team run by Adrian Balderrama.

Spangler’s department is also seeing summer interns return to become analysts. He said he’s found that young people really enjoy working in public finance because they enjoy the “tangible” nature of what the marketplace produces through bond deals, such as bridges and airports.

“It’s really helpful in training people and keeping people motivated,” he said.

Spangler thinks the first half of 2024 will look similar to 2023 and that his team’s sector-specific expertise will be key. The firm underwrote more than $6 billion of housing bonds and has benefited from having more than two dozen state housing finance agency clients, he noted.

General government borrowing may have been stymied in recent years, given that states and cities were flush with cash from federal aid, Spangler said. The U.S. stepped in with $350 billion of pandemic relief aid for state and local governments in 2021.

Spangler said he’s watching for interest rates to drop — a possibility in the second half of 2024 — so that bond deals for refinancings make a comeback. Falling rates would boost supply. He is predicting muni-bond issuance of $375 billion next year.

As things shake out at big banks’ public finance divisions, Spangler said he’s hopeful that heavyweights stay in the muni business, adding that firms like his once modeled their platforms off of Citi given their historical dominance in the space.

“The strength and the knowledge that’s out there is valued and valuable,” he said. “Let’s hope we get through this and get back to bigger volumes.”