Apr 6, 2021

Russia Inflation Hits Four-Year High, Adding to Rate-Hike Pressure

, Bloomberg News

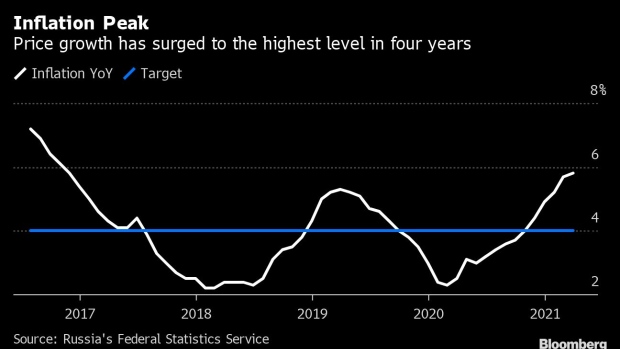

(Bloomberg) -- Russian inflation jumped to the highest level in more than four years in March, adding pressure on the central bank to keep raising interest rates.

Annual inflation accelerated to 5.8% in March, the Federal Statistics Service reported Tuesday, in line with forecasts but well above the central bank’s 4% target.

“Inflation risks are quite substantial and they are not only driven by external inflation, but also by domestic inflation,” Bank of Russia First Deputy Governor Ksenia Yudaeva told a conference Tuesday before the latest report was released. As in several other major emerging markets, Russia’s central bank has begun “slow” tightening of monetary policy in response, she said.

The Bank of Russia hiked its key rate by 25 basis points to 4.5% last month, warning that the economic recovery and inflationary pressures are stronger than it had forecast earlier.

In March, rising food prices were the main driver, up 7.6%, while food and vegetable prices rose 12% from a year ago.

The ruble has lost more than 3% against the U.S dollar since the beginning of March, adding to inflationary pressure and the central bank’s concerns. Policy makers meet April 23 to decide on rates again.

“Inflation acceleration in March is strengthening the arguments for the central bank to raise rates,” said Dmitry Dolgin, analyst at ING Bank in Moscow. “The central bank will weigh 25 or 50 basis points of increase but the market is ready for that scenario.”

Forward-rate agreements are pointing to 97 basis points of increases over the next three months.

What Our Economists Say:

“Inflation looks set to slow from here on base effects, but that’s a cold comfort for the central bank. Policy makers are looking for stronger evidence that the upward price pressure is fading.”

--Scott Johnson, Bloomberg Economics

The government was active in spending at the end of last year and in the beginning of 2021, which also spurred inflation, said Evgeny Gavrilenkov, economist and partner at GKEM Analytica.

“The peak of inflation was in March, it will ease after that,” said Sofya Donets, an economist at Renaissance Capital in Moscow. “The weak ruble is one of the main concerns.”

©2021 Bloomberg L.P.