Sep 16, 2022

Scholz Puts Full Muscle of German State Into Securing Energy

, Bloomberg News

(Bloomberg) -- Chancellor Olaf Scholz is putting billions of euros of public money on the line to keep Germany running as Moscow cuts off energy supplies, in a high-stakes gamble that risks tensions with his pro-market coalition partners.

The decision to seize control of Russian oil major Rosneft PJSC’s German oil refinery assets is likely just the first step in an overhaul that could see Berlin pressured to take over a big chunk of the energy sector in Europe’s largest economy, with consequences for years to come.

German taxpayers may also be left with potentially uncapped liabilities to maintain the supply of natural gas and electricity after Russia indefinitely stopped deliveries through the main Nordstream 1 pipeline earlier this month.

Scholz’s strategy adds pressure on the country’s finances at a time when Germany already risks tipping into recession as Russian President Vladimir Putin uses energy to punish Europe economically for supporting Ukraine. The experiment also raises questions over his vision for the economy and tests his relationship with the business-friendly Free Democrats that form the government alongside his Social Democrats and the Greens.

Germany is at the sharp end of the energy crisis rippling through Europe after decades of dependence on cheap imports of Russian oil and gas. Berlin has long promised a transition toward cleaner energy to power its industrial machine but has waited in vain for companies to engineer change, while the country has also turned its back on nuclear power.

Across the Rhine, the French government has lined up 12.7 billion euros ($12.7 billion) to cover the renationalization of Electricity de France SA and other possible operations, and this week outlined price caps to help households next year that will cost the power company 29 billion euros in lost earnings from its nuclear reactors. France’s Finance Ministry has argued the state is best placed to carry out the decades-long investment program required to cut dependence on imported fossil fuels.

Read more: France Offers Big Premium in Quest for Swift EDF Nationalization

Responsibility for shifting to renewable energy sources, while securing enough oil and natural gas deliveries from alternative suppliers to keep the lights on and factories humming, will also now land squarely on the shoulders of Scholz and his government.

“The nationalization of fossil energy companies is a necessary evil or a bitter pill that Germany has to swallow because we slipped into the fossil energy crisis through our own fault,” said Claudia Kemfert, head of the energy, transport and environment department at economic research institute DIW Berlin.

“If we had consistently implemented the energy transition, we wouldn’t have to nationalize any fossil energy companies today.”

Scholz, who as Angela Merkel’s finance minister was instrumental in convincing his predecessor to lift Germany’s debt brake to shield consumers and companies from the fallout of the Covid pandemic, insists he doesn’t believe in nationalizing industry except in exceptional circumstances.

His latest moves will set alarm bells ringing in many parts of Germany, however, not least in the offices of his pro-market finance minister, Christian Lindner. The leader of the Free Democrats (FDP) may see himself forced to ditch his promise to return to the constitution’s strict borrowing rules next year.

The government is also in advanced talks to nationalize Uniper, one of Germany’s biggest gas importers, and in separate negotiations to take a minority stake in VNG, another big gas importer, according to people familiar with the discussions.

Asked about nationalization plans at an FDP event in Oldenburg on Friday, Lindner said the basic convictions hadn’t changed, pointing to the fact the government just sold its full stake in Deutsche Lufthansa AG after bailing it out with 9 billion euros during the pandemic.

Read more: Germany Sells Full Stake in Lufthansa at $760 Million Profit

“Now, in the time of crisis, we have to make decisions in order to avert structural economic disruptions, and that is what we are doing,” he said, adding that the government had made “provisions for everything.”

The Rosneft move was in the works for weeks, with officials aware of the risk it could anger Putin and trigger an escalation in the energy crisis, two people familiar with the decision said on condition of anonymity. The Nordstream 1 stoppage removed this need for caution, they said.

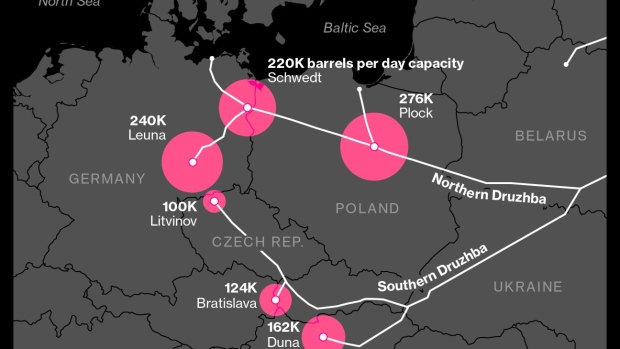

If Russia decides to retaliate and stop oil deliveries to Germany via the Druzhba pipeline, officials in the chancellery are now confident of finding alternative supplies.

A senior government official said on condition of anonymity that there is no way round taking over a very large majority stake in Uniper, which its chief executive said is racking up losses of as much as $100 million a day. These were not calculated in an initial bailout agreement sealed with Uniper’s Finish parent company, Fortum Oyj, in July. There is still no agreement on the main conditions in sight, the official added.

Meanwhile, Poland’s government and its biggest oil company, PKN Orlen SA, are in talks about boosting cooperation with and potentially buying a stake in Germany’s Schwedt refinery, according to a senior cabinet official.

©2022 Bloomberg L.P.