Apr 11, 2022

Sri Lanka Default Risk Seen High by Citi as Crisis Delays Loan

, Bloomberg News

(Bloomberg) -- Sri Lanka’s unprecedented interest-rate hike has helped restore the central bank’s credibility, although it’s not enough to remove the risk of a debt default as a political crisis delays an International Monetary Fund bailout, according to Citigroup Global Markets.

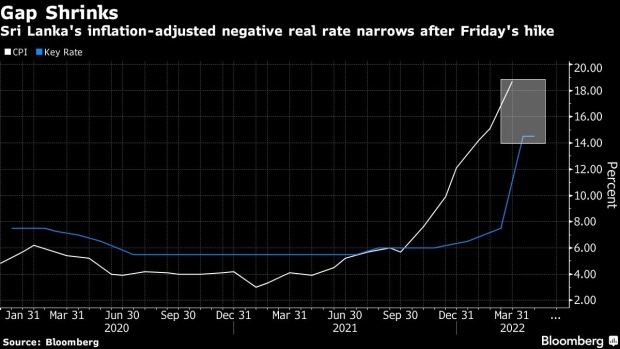

The Central Bank of Sri Lanka raised the key rate by 700 basis-points on Friday, narrowing the negative gap in real interest rates -- nominal rates adjusted for inflation -- to 420 basis points from 1,120 basis points previously.

“While this steep rate hike should help the rupee, stabilizing it may require progress on bridge financing, alongside material progress to a Fund program,” Johanna Chua, chief economist for Asia Pacific at Citigroup in Hong Kong, wrote in a report to clients. “We view risk of default as now very high.”

The IMF said over the weekend that it will hold discussions with senior Sri Lankan policy makers in the “coming days and weeks” about a possible support program to help the nation overcome an economic crisis that’s pushed citizens to seek President Gotabaya Rajapaksa’s ouster after his cabinet quit.

“The IMF may be reluctant to sign on to a program without more assurances of buy-in among stakeholders, including opposition parties,” Chua said. “Under President Gotabaya, it will likely remain challenging to assemble broad political support for tough policies negotiated under the IMF.”

Coupon payments on April 18 may be in jeopardy given depleted reserves, she said, adding that $1.94 billion of reserves in March is not enough to cover swaps with China, India and Bangladesh.

READ: Sri Lanka Faces Wall of Debt Payments Amid Economic Meltdown

©2022 Bloomberg L.P.