Mar 28, 2022

Stocks rise for third day as Nasdaq 100 climbs

, Bloomberg News

BNN Bloomberg's closing bell update: March 28, 2022

U.S. stocks climbed in afternoon trading in a rally underpinned by gains in megacaps and tech shares. Benchmark Treasuries reversed an earlier slide, while oil declined on China lockdown concerns.

The S&P 500 rose for a third day, closing up 0.7 per cent after falling as much as 0.6 per cent. The tech-heavy Nasdaq 100 jumped 1.6 per cent. Both indexes settled just off session highs. Oil tumbled as China’s worsening virus resurgence boosted concern over demand in the world’s biggest crude importer.

Equity markets remained sensitive to headlines on the war in Ukraine, dipping earlier after a report several peace negotiators suffered symptoms of suspected poisoning after a meeting in Kyiv earlier this month.

“This is a difficult market to make sense of because it’s unusual that we have so many factors at work,” Marc LoPresti, managing director of The Strategic Funds, said by phone. “But I think at the end of the day, the American economy remains strong. American consumer demand remains strong. We’re seeing continued improvement in the job market. All of those indicators do seem to imply that there is a healthy foundation in terms of the U.S. economy.”

Tesla Inc. gained after saying it plans to seek shareholder approval for a move that would enable another stock split. Bloomberg earlier reported the electric-vehicle maker was extending the temporary shutdown of its car plant in Shanghai due to the surge in cases in the city.

Apple Inc. extended its rally to a 10th day, the longest run since 2010, clawing back losses earlier in the day sparked by a report that it is cutting production of its iPhone SE line. Crypto stocks gained as Bitcoin erased it 2022 losses.

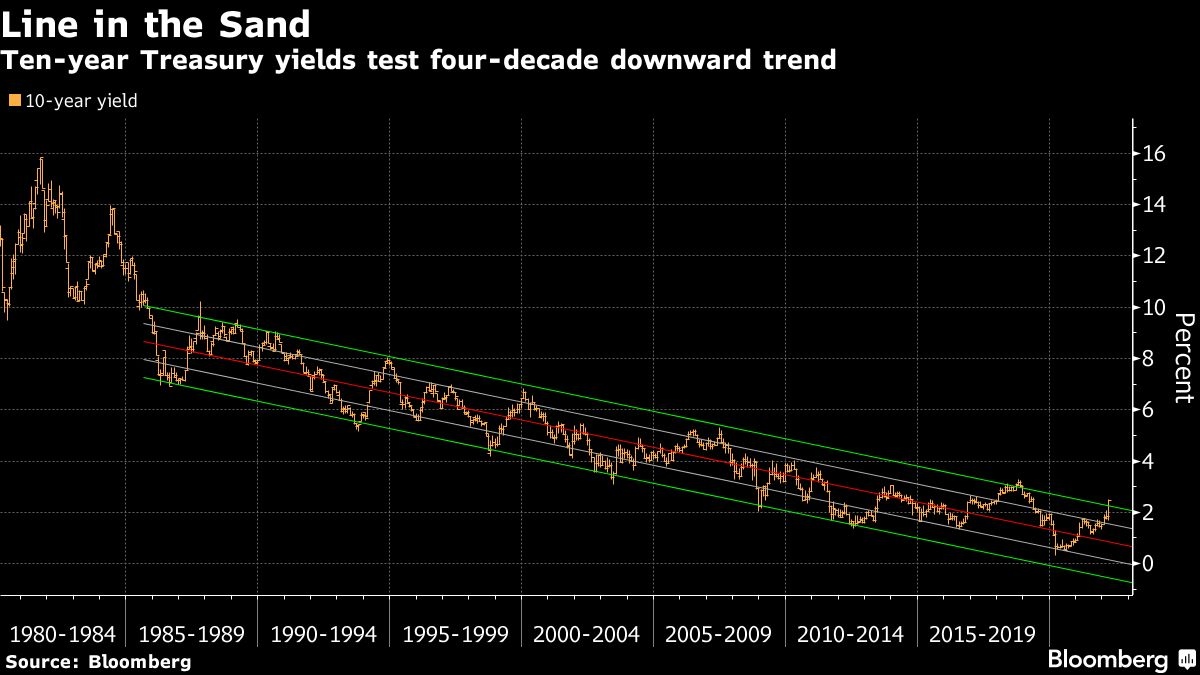

The 10-year Treasury yield traded near 2.45 per cent, from a session high of 2.55 per cent. Earlier yields on five-year Treasuries rose above those on 30-year bonds, suggesting some investors expect an economic downturn. The dollar gained versus most of its major peers.

A growing number of money managers are betting equity indexes have already largely priced in bearish bond moves, as equity strategists from Goldman Sachs Group Inc. to JPMorgan Chase & Co. reassure stock investors that there’s no need to fret about U.S. Treasury yield curve just yet.

Still, the war in Ukraine continues to disrupt supplies of key commodities, stoking inflation risks and expectations of more aggressive Federal Reserve tightening. Meanwhile, global shares have recovered from the lows sparked by Russia’s invasion.

In the latest geopolitical developments, Turkish President Recep Tayyip Erdogan said he will meet Russia and Ukraine delegations in Istanbul on Tuesday. President Joe Biden tried to temper comments calling for the removal of Vladimir Putin by saying the U.S. isn’t seeking regime change in Moscow.

On Monday, Biden unveiled a US$5.8 trillion budget, with a proposal that emphasized deficit reduction, additional funding for police and veterans, and flexibility to negotiate new social spending programs.

More commentary

- “With the clock running out on Q1, the market did something it’s done just one other time this year -- pieced together a two-week win streak,” Chris Larkin, managing director of trading at E*Trade from Morgan Stanley, said in an email. But stocks are still down for the quarter, and “with a stacked economic calendar and no shortage of macro factors at play, the jury is out on where exactly the market could end as Q1 draws to a close.”

- “The market’s recent success has been less about latest news flows getting better, but more about the news not getting worse, and in a real sense, likely priced into current valuations,” Art Hogan, chief market strategist at National Securities, wrote in a note. “Russia’s invasion of Ukraine shows few signs of ending. Fed Chairman Jerome Powell and other Fed governors have been talking up the possibility of half-point rate increases at upcoming meetings.”

- “When yields rise in a meaningful way, it pretty much always has a negative impact on the stock market eventually,” Matt Maley, chief market strategist at Miller Tabak + Co., said in a Monday note. “Those who think the stock market has already priced in such a large rise in yield” when the S&P 500 trades at more than 20x forward earnings “are not looking at history correctly.”

- “I think that this fast, fast move in the bond market and yields has caught people a little bit off guard,” Sarah Hunt, portfolio manager at Alpine Woods Capital Investors, said on Bloomberg TV. “It’s very difficult when bonds have more volatility than some of the things that are supposed to be volatile like Bitcoin.”

Some key events to watch this week:

- Australia’s annual budget, Tuesday

- Philadelphia Fed President Patrick Harker to speak, Tuesday

- U.S. GDP, Wednesday

- Richmond Fed President Thomas Barkin to speak, Wednesday

- China manufacturing, non-manufacturing PMIs, Thursday

- OPEC and non-OPEC ministerial meeting to discuss production targets, Thursday

- New York Fed President John Williams to speak, Thursday

- U.S. jobs report, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.7 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 1.6 per cent

- The Dow Jones Industrial Average rose 0.3 per cent

- The MSCI World index rose 0.4 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.4 per cent

- The euro was little changed at US$1.0987

- The British pound fell 0.7 per cent to US$1.3093

- The Japanese yen fell 1.5 per cent to 123.84 per dollar

Bonds

- The yield on 10-year Treasuries declined two basis points to 2.45 per cent

- Germany’s 10-year yield was little changed at 0.58 per cent

- Britain’s 10-year yield declined eight basis points to 1.62 per cent

Commodities

- West Texas Intermediate crude fell 9.4 per cent to US$103.15 a barrel

- Gold futures fell 1.9 per cent to US$1,923.30 an ounce