Feb 12, 2024

Temu spent millions on six Super Bowl ads as it tries to win back U.S. shoppers

, Bloomberg News

Super Bowl makes brands want to go all in, bigger and bolder: Leo Burnett's Steve Persico

Temu spent big at the Super Bowl on Sunday night, airing its advertisement six times and offering US$10 million in giveaways as it hopes to reinvigorate wavering U.S. growth.

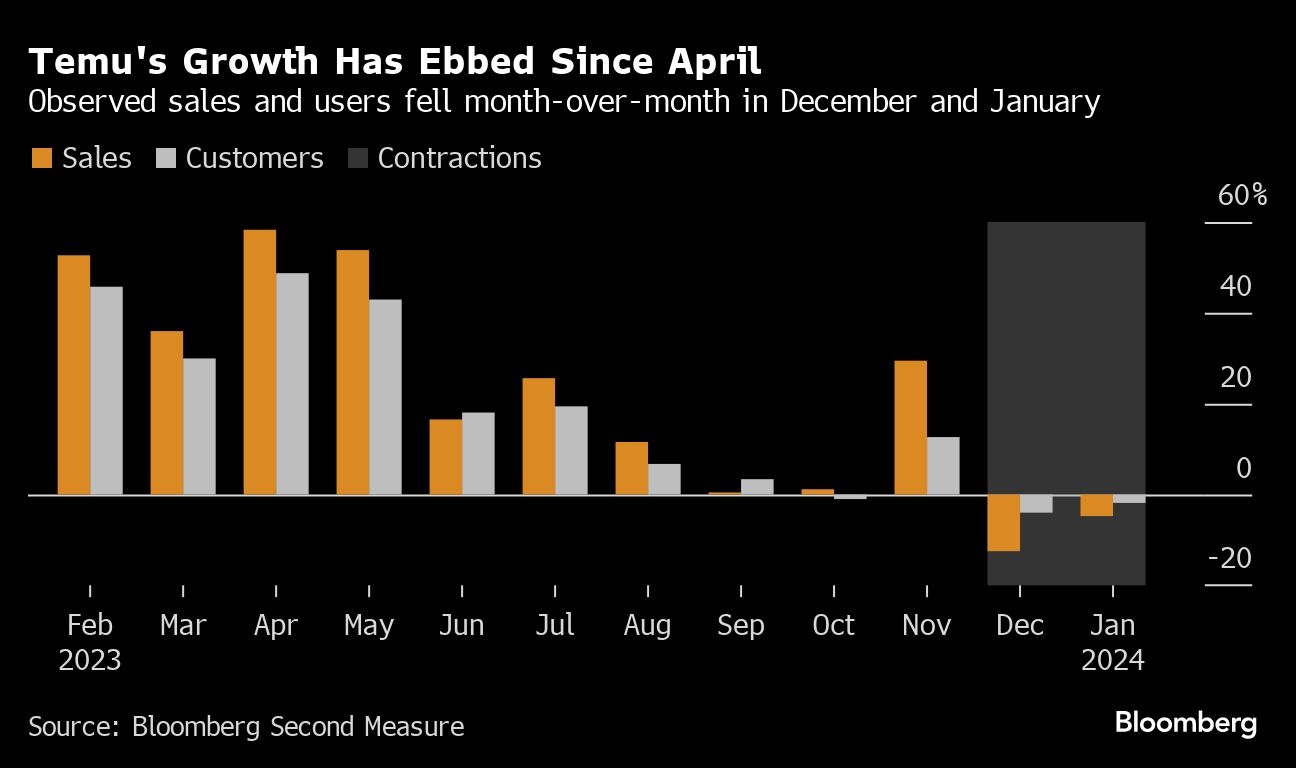

Observed sales fell 12.5 per cent month-on-month in December and 4.8 per cent in January, a sharp drop from the Chinese e-commerce app’s growth of more than 50 per cent in mid-2023, according to Bloomberg Second Measure data tracking a subset of U.S. credit and debit card transactions. Overall U.S. retail sales rose in December.

The number of Americans shopping on Temu is also falling, according to the Second Measure data, while a late-January survey from Morgan Stanley found nearly a third of its users plan to shop less on the app over the next three months — only eBay Inc. and Etsy Inc. had weaker outlooks.

Temu’s Super Bowl spend may have run into the tens of millions of dollars — a 30-second commercial during Sunday night’s game cost about $7 million. Web searches for the app spiked when its ads aired, according to Google Trends data, but searches have been steadily declining since early July.

The waning revenue and user figures raise questions around whether Temu’s explosive U.S. growth may be cresting long before it presents any real threat to juggernauts like Amazon.com Inc., which gained market share in December as shoppers prioritized speedy deliveries over Temu’s low prices but slow shipments.

Still, many analysts are looking past the waning sales. Temu shifted marketing spending to other countries toward the end of 2023, Sky Canaves, senior analyst at Insider Intelligence, said in an interview. “Their traffic and sales are still very dependent on the marketing and advertising budget,” she said.

Temu’s January sales were up 805 per cent versus January 2023, according to Second Measure data, quadruple the growth of second-place Space Exploration Technologies Corp. and far above rival Amazon’s 1.7 per cent.

Shares of Temu’s parent company PDD Holdings Inc. have fallen nearly 10 per cent this year, but its valuation has hovered around that of rival Alibaba Group Holding Ltd., which has more than three times PDD’s sales.

A recently announced plan to open its platform to American and European sellers could boost orders, Morningstar Inc. senior analyst Chelsey Tam said. But a return to its rapid growth would require PDD to keep offering steep discounts and rebates. Margins have declined in recent quarters and are expected to keep declining.

“Profitability is a concern. It’s just not a priority right now,” Tam said.