Apr 9, 2024

Tesla Ex-CEO Says It’s a Shame Musk May Have Delayed Low-Cost EV Plans

, Bloomberg News

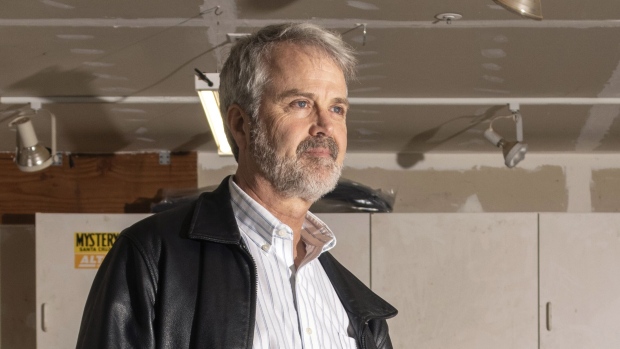

(Bloomberg) -- Tesla Inc.’s former Chief Executive Officer Martin Eberhard said it’s a shame the automaker may have scrapped its cheap car, since bringing down the price of electric vehicles is key to their uptake.

Eberhard co-founded Tesla, then known as Tesla Motors, with Marc Tarpenning in 2003 and served as the company’s first CEO until late 2007. He was in Hong Kong speaking at the inaugural HSBC Global Investment Summit on Tuesday.

“I read recently that Tesla has decided not to pursue their Model 2, their low-end car, because they don’t think they can compete with the low-end Chinese cars,” Eberhard said in a Bloomberg TV interview with Haslinda Amin. “That’s a shame, they might want to rethink that. It seems like a better market than that gigantic truck they make.”

Eberhard also described Toyota Motor Corp. as being “late to the EV game, which surprises me,” and said he has been “watching BYD for decades.”

China’s BYD Co. has a broad lineup of EVs, from the popular Seagull hatchback that sells for 69,800 yuan, or less than $10,000, to its Yangwang supercar that goes for 1.68 million yuan.

Reuters reported last week that Tesla had called off plans for a less-expensive vehicle, prompting a vague denial from current CEO Elon Musk. In a separate post on social media platform X, Musk responded with an eyes emoji to a Tesla investor who speculated Tesla was shifting more resources toward trying to bring a robotaxi to market.

Musk first teased a $25,000 EV during a battery-related event the company staged in September 2020. He said at the time that a series of innovations Tesla was working on gave him confidence the company could make an electric vehicle at that price point within about three years.

The CEO said last week that Tesla will unveil its long-promised robotaxi on Aug. 8. Its Cybertruck was unveiled to enormous fanfare in November 2019, but production was delayed for years and the ramp up of the vehicle has been slow.

Read More: Musk’s Cybertruck Is Already a Production Nightmare for Tesla

Eberhard said he was “super excited to see all these different characters in this space,” referring to both legacy auto manufacturers and now Chinese smartphone makers getting into electric cars.

While he expects Tesla to survive in the industry longer-term, even as others don’t, he said the company “needs to be focused on cost, instead of focusing on technology for the sake of technology.”

Eberhard, who separately recommended investors buy Apple Inc. stock, said the biggest challenge facing the EV industry was batteries and driving costs down.

“It’s important to understand that the automotive space is not like Silicon Valley in the sense that this is not a space in where there is a winner-takes-all technology,” he said. “We can have a dozen different cars companies around the world making a dozen different types of cars, meeting different positions in the market and all succeeding.”

--With assistance from Phoebe Sedgman.

(Updates with additional comments from the ninth paragraph.)

©2024 Bloomberg L.P.