Mar 24, 2023

Tether Expects First-Quarter Profit of $700 Million, CTO Says

, Bloomberg News

(Bloomberg) -- Tether Holdings Ltd., the issuer of the biggest stablecoin, expects to post a profit of about $700 million for this quarter, Chief Technology Officer Paolo Ardoino said.

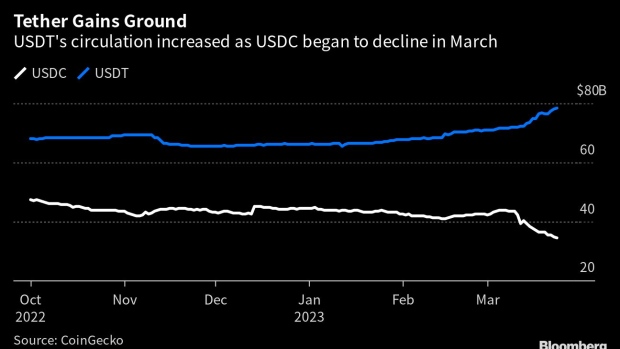

That’s similar to what Tether reported for the three months through December. The circulation of Tether’s stablecoin, USDT, has increased by 18% to since year-end, to $78 billion. Tether expects to end this quarter with an $1.6 billion surplus in the reserves it holds to back USDT’s peg to the dollar, Ardoino said in an interview on Wednesday.

Most of those reserves are now invested in short-dated US Treasury bills, Ardoino said, after Tether spent last year cutting its holdings of commercial paper. Cantor Fitzgerald is a custodian for Tether’s T-bill holdings, in addition to Bahamian lenders Deltec Bank & Trust Ltd. and Capital Union Bank, who assist in looking after its reserves, according to Ardoino.

“The risk management, all the financials, all the decisions are done internally,” Ardoino said, adding that Tether has its own “investment team” overseeing its portfolio and that it hopes to bring on more banking partners over time. Cantor Fitzgerald declined to comment, while Capital Union and Deltec didn’t immediately respond to requests for comment.

USDT’s circulation has surged in recent weeks, an increase that came mainly at the expense of its main competitor Circle Internet Financial Ltd.’s USD Coin. That token slumped from its peg to the dollar earlier this month, when news that Circle had deposits tied up with failed lender Silicon Valley Bank triggered a spike in redemptions of USDC.

With another major stablecoin, Paxos’s BUSD, in decline because of a crackdown by US authorities, USDT now accounts for almost 60% of the market.

Stablecoins like USDT are digital tokens designed to keep a 1-to-1 value with assets like the US dollar, typically by holding large reserves of cash or securities like T-bills as collateral. They are popular with traders who use them as a way to move funds between exchanges and as a safe haven from price swings, making them a key component in crypto markets.

That, in turn, means that runs on stablecoins can pose a serious threat to markets’ functioning.

Tether has spent much of the past year trying to assuage concerns about its reserves, which need to be liquid enough to withstand any potential surge in redemptions. USDT itself broke its dollar peg briefly in May, when the collapse of stablecoin TerraUSD ripped through crypto markets.

- Read more: Why Do Tether and Its USDT Coin Make People Nervous?: QuickTake

The company estimates that almost half of the daily holdings of USDT are used for remittances and as a “hedge against” national currencies, rather than for trading, Ardoino said.

Tether had around $5.3 billion of its reserves in cash and bank deposits at the end of 2022, a February filing showed, a decline of around 12% from the third quarter. Ardoino didn’t give a figure for current cash holdings.

Tether may invest as much as 20% of profits into other strategic projects, said Ardoino, who also is chief technology officer of crypto exchange Bitfinex and chief strategy officer of Holepunch, a peer-to-peer communications platform.

©2023 Bloomberg L.P.