Oct 14, 2022

Texas Pension With $184 Billion to Halve China Stock Allocation

, Bloomberg News

(Bloomberg) -- The manager of a $184 billion public pension fund for Texas public education employees is halving its target allocation to Chinese stocks, potentially cutting billions of dollars of such holdings over months.

Teacher Retirement System of Texas is switching to a new tailored emerging markets stock benchmark to reduce China’s “outsized weight” in the MSCI Emerging Markets Index it once relied upon, according to a previously unreported proposal approved at a mid-September meeting. The move will effectively see China’s long-term target weight in its portfolio cut to about 1.5%, a size similar to or even smaller than Taiwan.

The new benchmark which took effect Sept. 19 is an equal mix of the MSCI emerging markets indexes with and without China, according to a document submitted to the meeting. The pension, also known as TRS, is committed to maintaining a “prudent” 9% target allocation to emerging markets stocks.

The change was made to improve the diversification of the benchmark, Katy Hoffman, chief of staff of its investment management division, said in a video recording of the meeting posted on the pension’s website. There is a six-month transition period to adjust its current portfolio accordingly, intended to reduce negative price impact.

A year in the making, the change came at a time of heightened tensions between the US and China. An index of Chinese companies listed in Hong Kong is the third-worst performing primary global gauge tracked by Bloomberg this year, as they have come under the combined pressure of domestic regulatory reforms and tightening, geopolitical tensions and a pandemic-induced slowdown.

TRS is Texas’s largest public retirement system and among the top 25 in the world, according to its website. Trade journal Pensions & Investments ranked it the sixth-largest defined benefit pension plan in the US by 2021 assets. In an emailed response to Bloomberg News questions, TRS declined to say whether the China allocation change was driven by recent under-performance of the nation’s stocks or political considerations.

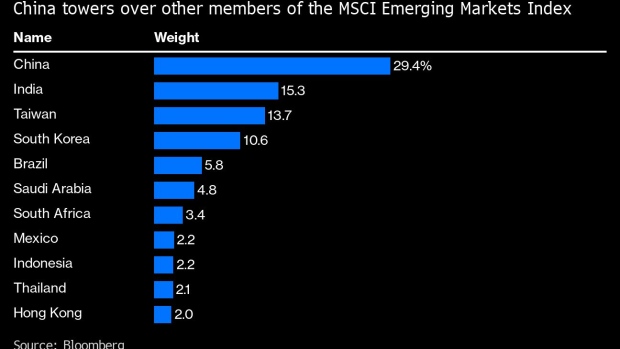

China had a 35.4% weight in the MSCI Emerging Markets Index, more than double the 14.5% for the next largest market: Taiwan, according to another document submitted to the TRS meeting. China’s weight would drop to 17.7% under the new benchmark, a touch below Taiwan’s 18.5%.

TRS held nearly $14.8 billion worth of emerging markets stocks at the end of June, or 8% of the total market value of investments, according to a financial report. It doesn’t specify how much of that was parked in Chinese stocks. TRS makes such investments both directly with internal staff and through external managers, including passive funds, it said in the email.

Shelved Plans

In 2019, TRS revealed a plan to open a Singapore office, seeking to join the small rank of North American retirement systems with a regional presence to boost Asia investments. It has shelved the plan for the moment, the email said.

TRS allows its emerging markets investments to vary between 4% to 14% of assets, with a long-term target of 9%. While such short-term “tactical” flexibility exists, the latest change was made as a strategic asset allocation shift, with long-lasting impact. Institutional investors use strategic allocation targets to guide long-term investments, regardless of short-term market volatility. Actual allocations may temporarily over- or under-shoot the targets, because of the availability of investment opportunities and assets price moves.

China and the US have ratcheted up their spat over a widening range of issues, including technology, accounting disclosure of US-listed Chinese companies, political freedom in Hong Kong and the future of Taiwan. The US has sanctioned Chinese officials over the treatment of Uighurs in Xinjiang, and curbed the Asian country’s access to semiconductor technology. The Trump Administration in 2019 weighed ways to limit US investors’ portfolio flows into China. Among the options was restricting Americans’ exposure to the Chinese market through public pension funds.

China’s weight in the MSCI Emerging Markets Index has since dropped to 29%. The gauge has tumbled 31% this year.

©2022 Bloomberg L.P.