Mar 8, 2024

The DEA Can Save the Withering Weed Industry. Will It?

, Bloomberg News

(Bloomberg) -- North America’s cannabis industry can’t afford much more political heartbreak.

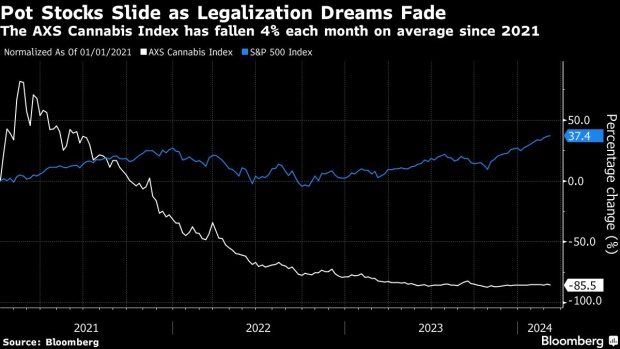

In the 14 months since the last failed US attempt at meaningful cannabis reform, weed stocks have tanked, investment’s dried up, sales have stagnated and spending on growth has shrunk. The industry’s now placing its hope in the government agency that’s responsible for much of its misery in the first place: the Drug Enforcement Administration.

Talk of rescheduling — moving marijuana from the most-restricted drug category to a lesser one — has overtaken talk of complete legalization on cannabis companies’ conference calls, according to transcripts analyzed by Bloomberg, following an August recommendation by the US Department of Health and Human Services that the DEA relax its stance.

It’s a drastic shift in focus. Legalization, once the industry’s holy grail, is now hardly being mentioned.

Cannabis companies believe they would pay hundreds of millions of dollars less each year in taxes and be eligible for cheaper loans if rescheduling goes through. Desperately needed funds from investors sidelined by legal red tape would also likely flow, as would public listings on US stock exchanges.

President Joe Biden raised marijuana reform in his State of the Union address Thursday night, pushing the probability that a rescheduling decision is made in the next few months to 80%, Bloomberg Intelligence said in a note Friday.

But a green light is far from guaranteed, and the longer the industry goes without meaningful change, the more likely it is to be snuffed out before it gets a real chance to flourish.

“There’s a lot of companies that have a runway or, I think, a little bit more like a fuse that is burning out,” TerrAscend Corp. Chairman Jason Wild said in an interview.

Lacking clarity from the federal government, weed companies are expected to cut their growth investments by about 28%, or $303 million, this year. Green Thumb Industries Inc. announced an extra $50 million share buyback last week even as analysts anticipate its capital expenditure will more than halve this year, suggesting the company may be struggling to return value to shareholders by expanding.

That underinvestment has weighed on growth, alongside competition with the illicit market and health concerns about high-potency products. Sales have been essentially flat since the start of last year, while triple-digit growth was the norm in 2020 and early 2021. Green Thumb, Verano Holdings Corp. and Trulieve Cannabis Corp. beat fourth-quarter revenue expectations when they reported last week — but expectations were low at just 3%.

The DEA classifies cannabis as a Schedule I narcotic currently — on par with heroin and more dangerous than fentanyl. While more than half the states have legalized marijuana, the fact that the federal government hasn’t means the industry pays higher taxes because it’s not allowed to deduct basic expenses like wages, or get tax credits.

“It’d be nice to be treated like every other industry and not have it where you have to be like a ninja in order to be truly cash flow positive,” TerrAscend’s Wild said.

Some are already acting as if the law has changed. Trulieve asked for, and received, $113 million in federal taxes back after using what it’s calling a “trade secret” legal strategy to argue it’s exempt from the relevant tax code — though its holding onto those funds in anticipation it may have to pay that money back.

Green Thumb sees rescheduling halving its tax burden, while Verano estimates it could’ve saved $80 million last year. It could also let consumers use credit cards at weed dispensaries, meaning companies could hold less cash and earn interest on reserves.

The lack of a federal cannabis policy change “allows these antiquated policies to further hinder economic growth at all levels of the industry,” Verano President Darren Weiss said in an emailed statement.

The pressure has kept the industry in the doldrums. The AXS Cannabis Index has fallen 85% since 2020 and Global X ETFs liquidated its cannabis fund this year after it fell 96% over its lifetime.

But the recent attitude shifts have some investors taking notice. Shares of some cannabis companies have rallied this year, with Trulieve surging more than 85%, Cresco Labs Inc. 14.5%, and Curaleaf Holdings Inc., Green Thumb, Verano all up about 3%.

“Now is the time to be deploying capital into these companies before there’s a ‘quote-unquote’ catalyst,” Poseidon Asset Management Co-Founder Emily Paxhia said in an interview. Poseidon holds stakes in Green Thumb and Ascend Wellness Holdings Inc., with plans to invest in others.

“I do think there are groups who are waiting on the sidelines for these specific markers from the federal government,” Paxhia said.

Without meaningful legislative change, a wave of mergers is likely, industry analysts say.

“If it doesn’t get done then we’ll start to see the consolidation of business that can’t survive here, we’ll start to see a lot of retail stores just go out of business,” Roth MKM Managing Director Scott Fortune said in an interview.

(Adds sixth paragraph with BI note. An earlier version corrected the name of the Drug Enforcement Administration in the second paragraph.)

©2024 Bloomberg L.P.