Jun 24, 2021

Tokyo Inflation Halts 10-Month Drop Amid Virus Restrictions

, Bloomberg News

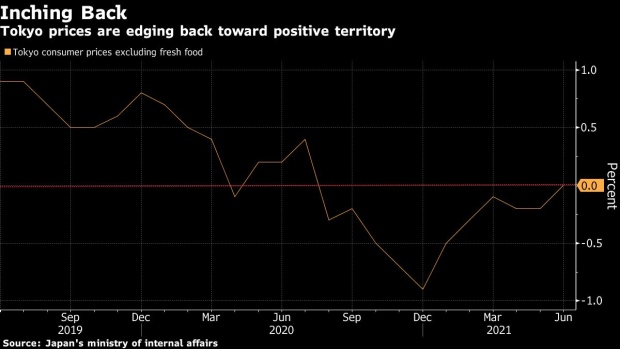

(Bloomberg) -- Tokyo consumer prices were flat in June, halting a 10-month slide even as business restrictions remained in place to contain the coronavirus.

Prices in the capital excluding fresh food were unchanged from a year earlier, the ministry of internal affairs reported Friday. Analysts had forecast a 0.1% drop.

Key Insights

- The data add to signs that downward pressures on Japan’s overall prices are moderating as commodity and energy costs rebound from last year’s pandemic crash. Gasoline prices are even more important to national price trends because people outside the capital tend to drive more.

- Still, Japan’s situation contrast with trends in the U.S. and other countries, where fear of inflation has started to fuel expectations for an eventual withdrawal of central bank stimulus. The Bank of Japan doesn’t see inflation hitting its 2% target before 2024, meaning it’s likely to keep easing for the foreseeable future.

- Consumers aren’t likely to trigger price gains anytime soon. Even after the government earlier this month lifted its latest declaration of emergency for most of the country, restrictions on restaurants and bars remain in place, so activity should stay subdued.

- Cuts to cellphone charges pushed by Prime Minister Yoshihide Suga this year continue to weigh on inflation, even as commodity prices push it up. Longer-term, anemic wage growth is a challenge that will probably have to be addressed for inflation to take hold.

What Bloomberg Economics Says...

“Looking ahead, we expect Tokyo’s CPI gauges -- which provide an early indication of nationwide trends -- to hover slightly above 0% in 3Q. That assumes virus infections are brought under control by June, taking pressure off the economy.”

--Yuki Masujima, economist

For the full report, click here.

Get More

- An index of overall Tokyo prices was flat, as was the index that strips out prices of both fresh food and energy. Economists had predicted falls in both.

(Adds detail on price changes.)

©2021 Bloomberg L.P.