Apr 20, 2023

TSMC Profit Beats After Chip Demand Fares Better Than Feared

, Bloomberg News

(Bloomberg) -- Taiwan Semiconductor Manufacturing Co. climbed as much as 1.4% after reaffirming its target for capital spending this year, in a sign Apple Inc.’s main chipmaker intends to shore up its lead in advanced semiconductors ahead of a tech recovery.

Taiwan’s largest company warned Thursday that demand from the mobile and PC industries remains “soft” for now, though the market was stabilizing and likely to improve in the second half. It’s sticking with earlier plans to spend as much as $36 billion upgrading and expanding capacity in 2023.

Executives stressed they must keep up investments in technology for the longer term, particularly as competition intensifies with Samsung Electronics Co. and Intel Corp. Ahead of the earnings, some analysts had speculated TSMC might curtail spending to tide it over a slump.

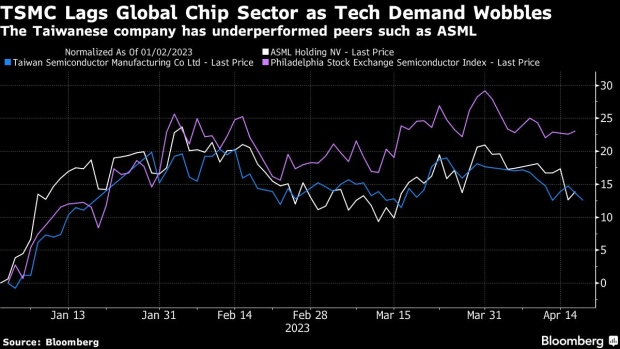

Shares of chipmaking gear-makers Advantest Corp. and Screen Holdings Co. rose more than 4% in Tokyo Friday after ASML Holding NV gained more than 1% in Europe, buoyed by TSMC’s decision.

TSMC — much like the rest of the industry — is grappling with uncertainty about electronics demand in 2023 and beyond, as consumers and corporations tighten their budgets to deal with soaring inflation and a potential global recession. It expects sales of $15.2 billion to $16 billion this quarter, a shade below the $16.1 billion analysts projected on average.

But it gave that outlook after posting first-quarter net income that beat lowered expectations, suggesting it’s keeping a lid on costs while taking advantage of its market leadership. It’s projecting gross margins of 52% to 54%, generally in line with the 52.5% average estimate.

“We are passing through the bottom of the cycle of TSMC’s business in the second quarter,” Chief Executive Officer C. C. Wei told analysts on a post-earnings conference call. But the PC and smartphone markets “continue to be soft at the present time.”

What Bloomberg Intelligence Says

Taiwan Semiconductor Manufacturing Co. is set to suffer the least sales decline among the top five global chip foundries in 2023, even as weak smartphone and PC chips demand dominates the industry this year. Secular demand for AI chips, coupled with TSMC’s steady migration to next-generation process nodes such as N3 in 2H23, N2 in 2025, and 3D-packaging technology, ensure its continued supremacy in the contract-chipmaking market, which could enable long-term gross margin to stay above 53%, far above peers. Overseas capacity expansion will be front and center, especially in the US and Japan, as TSMC is pushed to meet customers’ diversification requests and rises to the challenge of growing competition from Samsung and Intel.

- Charles Shum, analyst

Click here for the research.

One big question TSMC and its peers face is the extent of the global tech slump and whether China’s economy will bounce back strongly after dropping Covid Zero controls. The company said on Thursday it expects a low- to mid-single-digit revenue decline in 2023 — about in line with estimates.

TSMC posted net income of NT$206.9 billion ($6.8 billion) for the March quarter, compared with the NT$194.2 billion analysts projected on average. TSMC, maker of the most advanced chips for global electronics leaders from Apple to Nvidia Corp., had previously reported disappointing revenue for the three-month period.

TSMC Keeps Spending to Leverage the AI Boom: Tim Culpan

TSMC’s market leadership likely helped buoy its margins. On Wednesday, fellow industry bellwether ASML — the largest producer of equipment essential to advanced chipmaking — forecast better-than-anticipated June quarter revenue. But net bookings, a barometer for future growth, plunged 46% from a year earlier. Lam Research Corp., another equipment supplier to TSMC, also forecast adjusted earnings per share that missed the average analyst estimate.

TSMC Bulls Hold Firm in Face of Buffett’s Retreat: Tech Watch

Over the longer term, investors are hopeful that TSMC will benefit as a surge in artificial intelligence development and applications power demand for the high-end computing chips and datacenters required for training and hosting AI models.

A boom in development since OpenAI’s ChatGPT demonstrated the technology’s potential is driving sales of high-end chips, which in turn is helping whittle down the enormous stocks of chips that customers have held since the Covid era. That buildup in inventory had been larger than expected coming out of late 2022, executives said.

The outlook however remains clouded by geopolitical uncertainty, including global efforts to encroach upon TSMC’s turf in advanced chipmaking and China’s growing military threats against Taiwan.

Warren Buffett said in a recent interview that he divested the majority of Berkshire Hathaway Inc.’s $4.1 billion stake in TSMC partly due to geopolitical concerns.

TSMC is under pressure to produce its advanced chips abroad and is building more capacity in the US and Japan. Global policymakers and customers are increasingly wary of their technological reliance on Taiwan, which Beijing has claimed is part of China.

That’s driving government funding: TSMC has applied for federal funds under the US Chips and Science Act — intended to attract advanced chipmaking back to American shores — and the Japanese government is helping pay for half the cost of its $8 billion expansion there.

--With assistance from Cindy Wang, Gao Yuan, Betty Hou, Peter Elstrom, Sabrina Mao and Vlad Savov.

©2023 Bloomberg L.P.