Feb 16, 2022

U.S. retail sales rise most in 10 months in broad-based rebound

, Bloomberg News

U.S. CPI data shows inflationary pressures are broadening: Strategist

U.S. retail spending roared back to life at the start of the year, surging by the most in 10 months and highlighting a steady appetite for merchandise like cars and furniture.

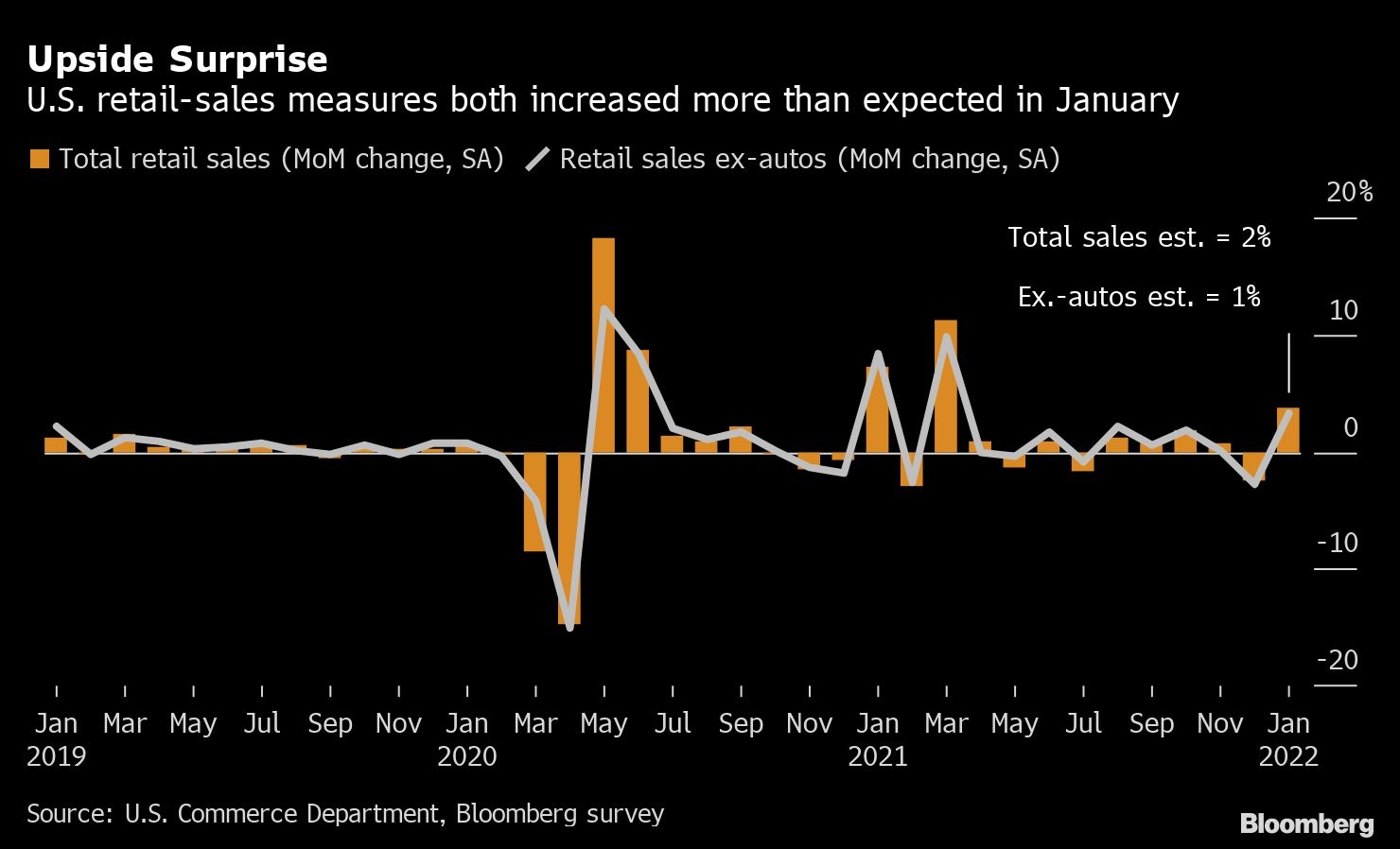

The value of overall purchases rose 3.8 per cent in January after a downwardly revised 2.5 per cent drop in the prior month, Commerce Department figures showed Wednesday. The advance was nearly double the median estimate of 2 per cent.

While the retail sales data aren’t adjusted for price changes, which makes the figures appear larger, the report suggests consumer spending in the first quarter got off to a better-than-expected start even after accounting for faster inflation.

“The data are signaling ongoing strong demand for goods -- although retail activity is also seeing a solid lift from high prices,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics. The readings “are sending a positive signal for household spending in January, even as omicron effects persisted last month.”

The broad-based advance illustrates how an improving labor market has helped consumers continue to spend despite decades-high inflation and a collapse in confidence. Still, manufacturers are struggling to keep up, with factory output rising just modestly in January. It’s also unclear how outlays on services fared during the COVID-19 surge.

Eight of the 13 retail categories rose in the month. Sales at non-store retailers surged 14.5 per cent after plummeting in December. Motor vehicle sales rose 5.7 per cent following a decline in the prior month. Home furnishing stores also posted a solid sales advance.

Receipts at restaurants and bars, the report’s only services-oriented category, fell 0.9 per cent, likely reflecting the record surge in COVID-19 cases seen in January. Data on inflation-adjusted personal spending and overall services spending will be out next week, offering a fuller picture of consumer outlays in the month.

What Bloomberg Economics Says...

“Retail sales’ stellar performance in January comes after sizable downward revisions to December’s reading, suggesting consumers were hit more than previously estimated by the latest COVID wave, but the recovery was rapid.”

-- Yelena Shulyatyeva and Andrew Husby, economists

Before the report, economists were projecting U.S. economic growth to slow to a 1.7 per cent annualized pace in the first quarter, a sharp deceleration from the 6.9 per cent seen in the final three months of 2021. Following the report, several economists said the stronger-than-expected report presents upside risks to first quarter gross domestic product estimates.

“The immediate consequence of these numbers is that forecasts for first quarter GDP growth will be revised up meaningfully,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics. “We think consumption is now on course to rise by about 5 per cent, with GDP growth at about 4 per cent, double our previous forecast.”

Still, the expiration of monthly child tax credit payments -- a program that gave millions of families up to US$300 per child each month -- presents a headwind to growth in the near term, on top of inflation and COVID-19.

Excluding motor vehicles, retail sales rose 3.3 per cent, topping all expectations. So-called control group sales -- which are used to calculate GDP and exclude food services, auto dealers, building materials stores and gasoline stations -- increased 4.8 per cent, also the strongest since March.