Mar 10, 2021

U.S. stocks rise as tech lags; Treasuries climb

, Bloomberg News

BNN Bloomberg's closing bell update: March 10, 2021

U.S. equities advanced as the rotation into value stocks resumed following a weak inflation report. Treasury yields turned lower after a 10-year note auction. The dollar weakened.

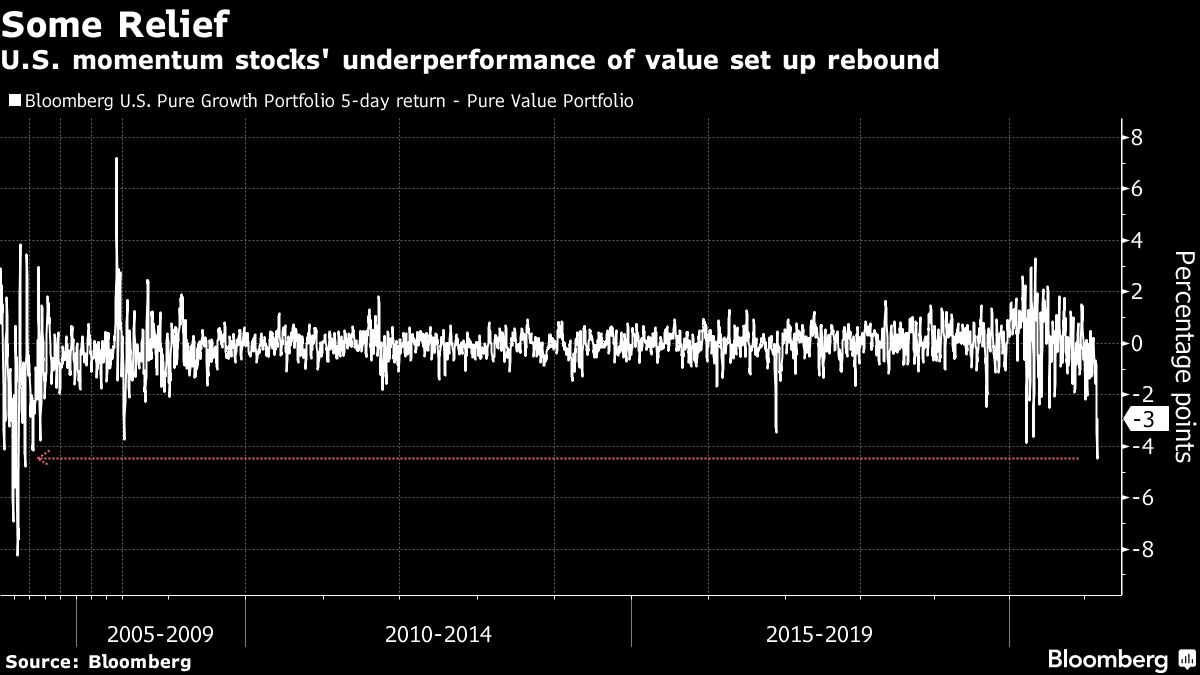

The S&P 500 notched its best two-day advance since early February, led by financial firms and producers of raw materials. A lower-than-expected inflation reading eased concern that prices will spike higher if growth picks up as many economists now predict. Tech shares whose valuations look stretched in an era of higher yields slipped after Tuesday’s rebound from weeks of selling.

The yield on the 10-year Treasury note fell toward 1.50 per cent, with bonds rising after a government auction. The dollar retreated. The threat of higher prices as the economy revs and the Biden administration signs a US$1.9 trillion spending package drove the rotation from growth stocks that led all of 2020 and into companies with businesses more closely tied to the economic cycle.

The dollar weakened versus major peers, sending the euro and pound higher. The Stoxx Europe 600 Index advanced. Crude topped $64 a barrel in New York, while gold futures edged higher. Bitcoin briefly topped US$57,000.

Here are some key events to watch:

The U.S. government auctions 30-year Treasuries Thursday.

The European Central Bank holds its monetary policy meeting and President Christine Lagarde is set to do a briefing Thursday.

These are the main moves in markets:

Stocks

The S&P 500 Index rose 0.6 per cent as of 4 p.m. New York time.

The Nasdaq 100 fell 0.3 per cent.

The Stoxx Europe 600 Index climbed 0.4 per cent.

The MSCI Asia Pacific Index gained 0.4 per cent.

The MSCI Emerging Market Index rose 0.8 per cent.

Currencies

The Bloomberg Dollar Spot Index slumped 0.3 per cent.

The euro was little rose 0.2 per cent to US$1.1925.

The British pound added 0.3 per cent to US$1.3931.

The onshore yuan was little changed at 6.508 per dollar.

The Japanese yen rose 0.1 per cent to 108.40 per dollar.

Bonds

The yield on 10-year Treasuries fell one basis point to 1.52 per cent.

The yield on two-year Treasuries dropped one basis point to 0.15 per cent.

Germany’s 10-year yield declined one basis point to -0.31 per cent.

Britain’s 10-year yield fell one basis point to 0.714 per cent.

Japan’s 10-year yield climbed less than one basis point to 0.128 per cent.

Commodities

West Texas Intermediate crude gained 1.2 per cent to US$64.78 a barrel.

Brent crude increased 1 per cent to US$68.22 a barrel.

Gold futures rose 0.4 per cent to US$1,723.50 an ounce.

--With assistance from Ye Xie.