Feb 1, 2024

US Factory Gauge Climbs to Highest Since 2022 on Orders Growth

, Bloomberg News

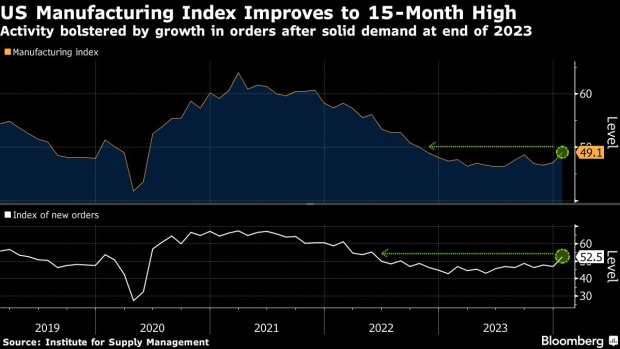

(Bloomberg) -- A measure of US factory activity climbed to a 15-month high at the start of the year, fueled by the strongest orders growth since May 2022 and suggesting manufacturing is starting to stabilize.

The Institute for Supply Management’s manufacturing gauge rose 2 points to 49.1 last month, according to data released Thursday. While still below the level of 50 that indicates shrinking activity, the figure exceeded all but one estimate in a Bloomberg survey of economists.

The 5.5-point increase in the orders index marked the largest monthly advance in more than three years, helped by robust demand in the last half of 2023. Production expanded for the first time in four months, while a gauge of customer inventories showed the leanest stockpiles since October 2022.

“This could be the beginnings of growth,” Timothy Fiore, chair of the ISM manufacturing survey committee, said on a call with reporters. “We’ve been waiting for this, and I think we need to get through the quarter to really see it.”

The nation’s purchasing and supply management executives are optimistic about the economy’s prospects as the Federal Reserve has signaled it will lower interest rates this year.

Four industries reported growth in January, including apparel and transportation equipment, while 13 indicated contracting activity.

Fed policymakers on Wednesday left their benchmark rate unchanged for a fourth-straight meeting and signaled an openness to cutting it. After the meeting, Fed Chair Jerome Powell dashed investors’ hopes that reductions would begin in March.

The ISM’s survey pointed to remaining hurdles for a recovery in US manufacturing. While domestic demand has been steady, the group’s export orders gauge showed overseas customers are pulling back. The index fell 4.7 points to 45.2 in January, marking the fastest rate of contraction since May 2020.

Price pressures also bubbled up in January. The ISM’s prices-paid index showed materials costs rose for the first time since April.

Select ISM Industry Comments

“The start of 2024 looks good. Sales are above expectations, and costs are mostly stable. A few commodities are up in cost due to supply shortages. Many previously short commodities market positions have corrected themselves.” — Chemical Products

“The commercial vehicle market appears to be retracting a bit in 2024 compared to last year.” — Transportation Equipment

“Business continues to stabilize. Cash flow will be tight in 2024.” — Food, Beverages & Tobacco Products

“US economic outlook is affecting customer orders, and the current backlog is quite low compared to past quarters. Waiting on potential improvements from the CHIPS and Science Act.” — Computer & Electronic Products

“December sales were very strong but slower for the first part of January, as was expected. We expect to see steady sales going forward, if the (Fed) continues to hold rates and suggests a rate cut in the future.” — Machinery

“Good start to the year. We had budgeted a 3.5-percent increase over 2023. We expect it to be a challenging year. Currently, orders are positive in our automotive OEM and automotive aftermarket business. Our industrial business sector is looking weak at the moment.” Fabricated Metals

“Demand continues to be slow. Reduction from the second half of 2023 has continued into this year. We are adjusting production to match demand.” — Electrical Equipment & Appliances

“Current industry conditions are positive; however, a note of caution as we see potential headwinds with downward price movements in the coming months.” Primary Metals

“Remarkable slowdown in business in December. January has picked up, but not to previous-year levels.” — Textile Mills

--With assistance from Chris Middleton.

(Adds ISM comment)

©2024 Bloomberg L.P.