Oct 13, 2022

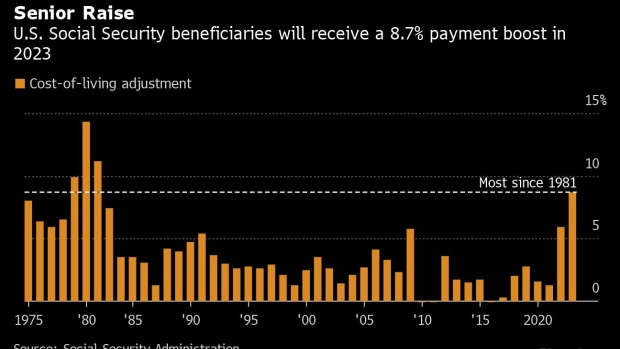

US Retirees Get a 8.7% Boost in Social Security, Most Since 1981

, Bloomberg News

(Bloomberg) -- The roughly 65 million retirees who collect Social Security benefits in the US will get a 8.7% increase next year, the largest bump since 1981, to compensate for the highest inflation bout in four decades.

The cost-of-living adjustment, known as COLA, will apply to Social Security and Supplemental Security income payments starting in January, the Social Security Administration said Thursday. It will increase the average benefit by about $140 per month.

The higher monthly payments will help seniors cope with the surge in consumer prices, which peaked this year at 9.1% and has left many struggling to pay for everyday bills. September inflation data released Thursday showed broad-based advances in the prices of necessities including food and medical care.

The purpose of the COLA is to ensure that the purchasing power of Social Security beneficiaries isn’t eroded by inflation. Next year’s boost essentially does just that.

“That extra $140 reflects the inflation they’ve already experienced over the last 12 months, so if anything, it should allow them to purchase the same basket of goods and services as before,” said Omair Sharif, founder and president of Inflation Insights. “But in the grand scheme of things, you’re talking about $9.1 billion into the economy if they were to spend it all. That’s a drop in the bucket of consumer spending.”

Still, Social Security payments are the equivalent of wages for seniors, and the big bump in their benefits could feed into the inflation loop that Federal Reserve policy makers are trying to break with aggressive hikes in interest rates.

Higher income “makes it that much easier for firms to hike prices again,” Stephen Stanley, chief economist at Amherst Pierpoint, said in a note. “If the cycle continues, inflation eventually becomes deeply ingrained in the economy.”

Overall, inflation has abated since its June peak, but in part because of falling prices of gas and used cars. Prices paid by consumers rose 8.2% in September from a year earlier, still an elevated level compared with averages of the past four decades.

©2022 Bloomberg L.P.