May 31, 2022

Who’s In and Out of the FTSE 100 Benchmark at Latest Reshuffle

, Bloomberg News

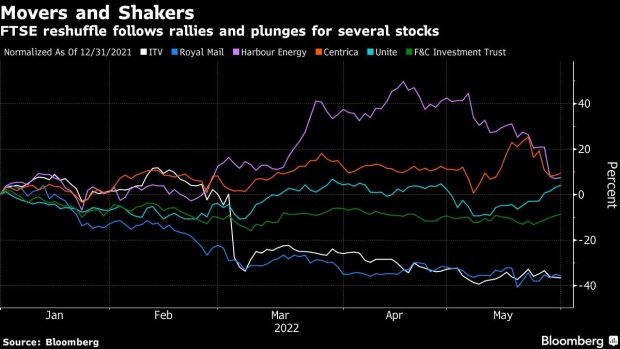

(Bloomberg) -- UK’s FTSE 100 stock benchmark is set for a big reshuffle as investors switched their portfolios rapidly amid the ongoing cost-of-living crisis and a brutal war in Ukraine.

Broadcaster ITV Plc, delivery group Royal Mail Plc and North Sea oil driller Harbour Energy Plc are likely to drop out of the UK index, Hargreaves Lansdown analyst Susannah Streeter predicted ahead of an announcement from FTSE Russell, a unit of the London Stock Exchange Plc, on Wednesday.

British Gas-owner Centrica Plc, student housing firm Unite Group Plc and technology investor F&C Investment Trust Plc are the possible replacements, added Streeter. However, this could still change as the index changes will be determined by closing prices Tuesday.

Harbour Energy’s potential exit follows a plunge spurred by a 25% windfall tax -- announced by Chancellor of the Exchequer Rishi Sunak last week -- amid pressure to raise funds to help with household energy costs. Small companies such as Harbour will be hit harder than major firms like Shell Plc and BP Plc, which have greater geographical diversification, Bank of America Corp. analyst Christopher Kuplent said in a note.

Meanwhile, Royal Mail has faced fading tailwinds from the pandemic-era online shopping and virus testing pack deliveries, and ITV is bracing for a slowdown in advertising spending due to worries about the economy, analysts say.

Centrica’s promotion comes as soaring energy prices spur calls for the group to resume shareholder payouts. FTSE Russell said last week in indicative changes that Johnson Matthey Plc could join the index alongside Centrica. However, the chemical firm’s shares sank following results on Thursday that it said were hampered by supply disruptions.

©2022 Bloomberg L.P.