Nov 29, 2019

4 apps that can help you manage your money better

, BNN Bloomberg

How tracking your spending habits can help you make a realistic financial plan

Your daily latte, drinks with work colleagues, date night – it’s easy to lose track of your finances when you can pay with just the tap of a card.

But what happens at the end of the month when you’re left with less than you expected in the bank? Sometimes we don’t have the chance to break out a spreadsheet or shoebox full of receipts. However, there are a number of financial apps that can help you keep track of your spending at all times.

Lauren Rudolph, associate portfolio manager at Kerr Financial Group., touts the benefits these apps can have in terms of providing opportunities to build wealth.

“The main benefit from tracking finances on an app is the fact that they allow you to control building wealth. It’s crucial for millennials since most of the things they can do to benefit their personal finances is within their control,” Rudolph said in a phone interview with BNN Bloomberg.

“These apps let you build a budget, invest money regularly and find opportunities for you to save in your finances.”

While some personal finance experts strongly recommend using financial apps, others warn users to read the terms and conditions before signing up for anything.

“As much as we want the convenience for one app to track our finances, when you do so with these apps that link into your bank account or investment account you nullify the protection agreements offer you for hacking,“ said Kelley Keehn, consumer advocate at FP Canada, in a phone interview with BNN Bloomberg.

“You could look at your own bank first to see what they offer or switch to another bank for their tracking. Know the risk before signing up for anything.”

With that in mind, here’s a look at four free apps that keep track of your finances for different needs.

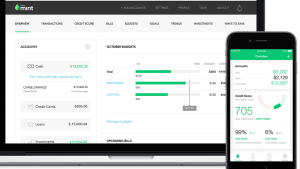

For people who want an all-in-one financial app

Mint allows you to link your credit cards, banking institutions, loans and investments organizations all in one place. The app also has a strong base of additional financial services such as providing your credit score, insurance quotes and student loan tracking. Tilak Joshi, vice president and head of Mint, says they have seen a steady increase in demand for financial apps.

“Not everyone is a financial expert but with the app they can get insights and into their finances with life and decisions. We are pushing more features to better match the growing need for simplicity and value from apps,” he said in a phone interview with BNN Bloomberg.

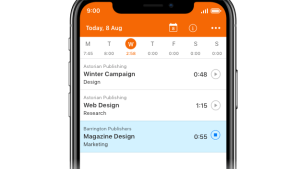

If you are a freelancer or entrepreneur

Harvest lets you track your time and expenses with work and project budgets. For freelancers, this app is particularly helpful as it tracks invoices and can create an invoice form for clients. Users can log expenses by taking a picture of a receipt, so by the end of the year, all work expenses can be stored in one place.

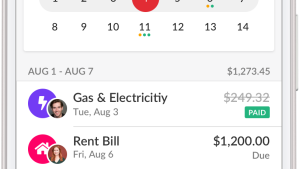

For couples who want to track their finances together

Whether you’re married or just moved into your first apartment together, Honeydue allows you to track your finances as a couple.

“If you just moved in you might not be comfortable setting up a joint bank account together or sharing all your information, so we made it easy for couples to merge those things while choosing what you want to share with your partner,” said Eugene Park, CEO and co-founder of Honeydue, in a phone interview with BNN Bloomberg.

The app lets you coordinate bills together and set up reminders for when expenses are coming up. It also provides a chat function which lets you talk to your significant other about transactions.

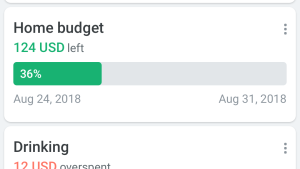

For someone who wants to focus on budgeting

Spendee is a financial app that is great for someone who wants an easy way to start budgeting. The app lets you set budgets for different things whether that’s food or shopping and set individual targets for each section.

“Attention is growing not just for our app but for others as well, since there’s a lack of financial knowledge among many people and banks don’t always meet the expectations of what someone is looking for with their apps,” said Pavla Rýznarová, COO of Spendee, said in a phone interview.

“They want to do something about their money, but they also want to have less stress about their financial decisions.”