Oct 23, 2022

After $50 Billion Wipeout, More Pain Ahead for Kakao Investors

, Bloomberg News

(Bloomberg) -- After a $50 billion wipeout in market value this year, more pain may be in store for investors in Kakao Corp. and its affiliates as the Korean tech group’s monopoly-like status draws a steady stream of criticism.

Once hailed as a symbol of Korean innovation, Kakao’s market value reached a peak of over $60 billion last year on a pandemic boost as a “stay-at-home” beneficiary and gains from the listing of several subsidiaries.

Its fall from grace mirrors moves to minimize the power of tech giants from the US to China. A recent data center fire that caused an outage of South Korea’s No. 1 messaging app added force to a public campaign since last year to curb Kakao’s influence.

Company founder Brian Kim as well as executives from SK Group, an affiliate of which operated the stricken datacenter, apologized and promised compensation during a parliamentary hearing Monday, without elaborating. The founder of rival Naver Corp., Lee Hae-jin, told lawmakers his own company was affected but managed to swiftly restore data.

“Kakao has become a monopoly so the perception has changed,” said Hong Chunuk, chief executive at Frism Investment Advisory Inc. and former economist at National Pension Service. “It has become a target of public disdain.”

Read more: Kakao Co-CEO Resigns After Outage Hit Millions in Korea

The blackout of Kakaotalk, which is used by the nation’s central bank to announce rate decisions and by government officials to discuss national security issues, heightened calls for oversight. Rival Telegram said it saw a surge in downloads in South Korea as users sought alternatives.

The company’s recent fintech spinoffs have seen the steepest declines, with shares of Kakaopay Corp. plunging 80% since the start of the year and KakaoBank Corp. down more than 70%. Combined market cap loss for Kakao, KakaoBank, Kakaopay and Kakao Games Corp. reached $50 billion this year through last Friday.

“They are some of the stocks that surged the most last year,” said Frism’s Hong. “There is also the issue of an increased number of stocks in the market after split-offs and listings of units, which also give a holding company discount to Kakao.”

Shares of Kakao and Naver, which has also been a target of criticism for market dominance, have fallen about 56% each this year.

Margin Calls

The sharp share-price losses appear to already have triggered margin calls for highly leveraged retail traders, as Kakao and its affiliates are popular among South Korean retail investors, Hong said.

Kakaopay and KakaoBank separately confirmed to Bloomberg that they took measures to help employees who may be facing margin calls after buying shares in the initial public offerings. Investors can sometimes be forced to sell shares to meet margin calls.

Less Bullish

A flurry of brokerages lowered their price targets on Kakao following the Oct. 15 fire. JPMorgan analyst Stanley Yang slashed his target 39% to 46,000 won, the lowest among 33 analysts polled by Bloomberg.

Credit Suisse lowered its rating to neutral from outperform last week, a rare downgrade for a stock that still has 27 buy ratings. Analysts are less sanguine on the listed units, with four sells on Kakaopay and three on KakaoBank.

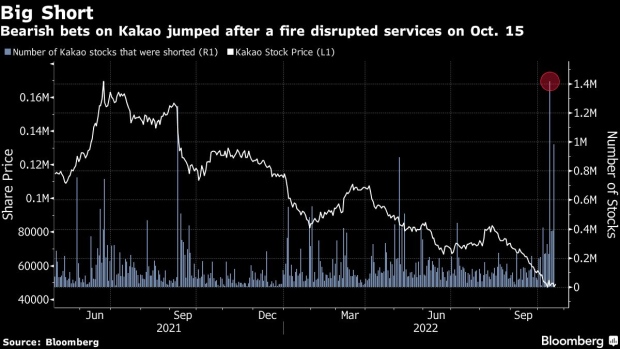

Big Short

In another bearish sign, daily short sales of on Kakao’s stock jumped to the highest on record last Monday and remained elevated through the rest of the week.

Kakao may struggle to gain new users as public opinion sours, said Gu Sungjoong, an analyst at DS Investment & Securities Co. “There’s potential concern about increased regulations on platform services that could limit its service expansion.”

--With assistance from Filipe Pacheco, Karen Yang and Sohee Kim.

(Updates with details of Monday’s hearings in the fourth paragraph)

©2022 Bloomberg L.P.