Jun 27, 2023

AI Frenzy Draws Hordes to Private Markets in Industry Gold Rush

, Bloomberg News

(Bloomberg) -- The buzz around artificial intelligence has investors snapping up shares of startups on alternative venues, looking to find the next wave of technology giants before they even go public.

AI and machine learning have remained the most in-demand sectors every month this year, accounting for 25% to 30% of investor interest, according to EquityZen Securities Inc., a marketplace for privately held shares. On Rainmaker Securities, a platform that facilitates secondary stock transactions for private businesses, investors are paying up for shares of companies like OpenAI and Anthropic, startups that are seen as leading the pack in AI.

“Institutional investors are getting much more aggressive,” Brianne Lynch, EquityZen’s head of market insight, said in an interview. Transactions among retail investors in AI companies also picked up from May to June, she said.

Rainmaker’s co-founder Glen Anderson noted the number of buyers is outstripping those looking to sell, pushing prices well above earlier funding rounds. Anthropic bidders are willing to pay as much as a 25% premium to its recent round, while OpenAI bids are into the $80s from what he believes was an earlier round priced at $67, he said.

Bankrupt cryptocurrency exchange FTC has abruptly halted the sale of its stake in Anthropic, as its valuation is seen benefiting from the current AI frenzy, Bloomberg News reported.

Read: FTX Said to Halt Sale of Stake in Buzzy AI Startup Anthropic

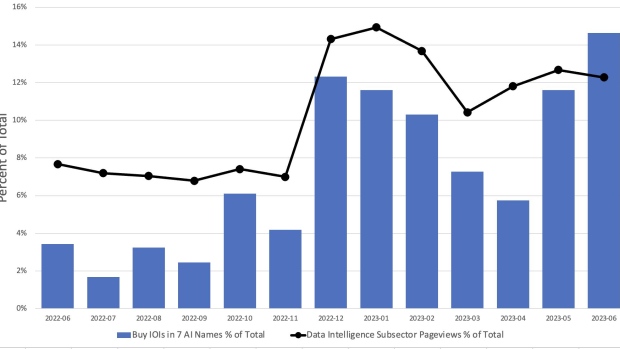

Forge Global Holdings Inc. has seen an increase in demand for AI firms on its platform over the past year, with Microsoft Corp.’s investment in OpenAI in January and a round of funding for Anthropic among the key drivers. In June, buying interest in a group of seven AI companies, including OpenAI, reached the highest level over the period, data provided by the firm show.

The scramble for nascent AI firms stands in sharp contrast to the broader trend of startups trading at massive discounts in this corner of the market. Here, cash-strapped founders, employees and investors are under pressure to sell shares amid a wave of tech job cuts, a tepid market for initial public offerings and rising interest rates.

Read More: Startup Shares Trading at 61% Discount Lure Venture Capital

It’s a different story for AI, which has captivated the likes of billionaire investors Steve Cohen, Stan Druckenmiller and Lee Ainslie, and pushed companies to consider how they can deploy the technology.

While AI is a burgeoning industry with growth potential and rising investor interest, it’s still at an infant stage and many firms don’t have robust financial reports to go public just yet.

That leads to the pent-up demand in this secondary market, EquityZen’s Lynch said, “because investors know these IPOs aren’t happening soon so they can’t access them that way.”

--With assistance from Philip Sanders.

(Adds report that FTX halted Anthropic stake sale in the fifth graph)

©2023 Bloomberg L.P.