Jan 31, 2022

BOE’s First Back-to-Back Hikes in 17 Years May Just Be the Start

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The Bank of England, one of the first movers in what looks set to be a rapid global tightening of monetary policy, this week will give a big clue about how far and fast it will move in combating inflation.

Policy makers led by Governor Andrew Bailey are expected to hike interest rates to 0.5% on Thursday, according to a survey of economists by Bloomberg. That would complete the first back-to-back increase since 2004 and open the question of whether more increases will follow.

The central bank’s latest forecasts also due with the decision will be key part of the answer. Analysts also are looking for words from Bailey at a press conference about how policy makers will respond to a surge in energy costs that’s helping drive up the prices at the fastest pace in three decades.

“More hikes are likely given the scale and persistence of inflation,” said Sanjay Raja, an economist at Deutsche Bank AG, who expects two hikes this year and another two in 2023. The risk is, he said, that “more will be needed and perhaps at a faster pace.”

Economists surveyed by Bloomberg unanimously expect an upgrade for 2022 inflation, while almost two-thirds also see a boost for 2023’s prediction. Most anticipate a hike in in the key rate to 0.5% on Feb. 3, with the BOE confirming it will stop reinvesting in government bonds that mature in its 895 billion pound ($1.2 trillion) asset portfolio.

“If they think the conditions are ripe for hiking, surely the conditions are also ripe for roll-off?” said George Buckley, U.K. economist at Nomura International Plc.

What Bloomberg Economics Says ...

“Our base case is that policy makers push back against market pricing by projecting inflation below 2% in the medium term and maintaining the language that a “modest tightening” of policy will be needed over the next three years. But we see a risk that the MPC endorses the curve by predicting inflation at target in two and three years time.”

Dan Hanson, Bloomberg Economics. Click for the PREVIEW.

While policy makers signaled in November that investors were too aggressive in anticipating rates at 1% by the end of 2022, developments since then have blown that guidance out of the water.

Inflation hit a 30-year high in December, and the jobs market grew strongly, pushing up wages. Bank officials already expect inflation to surpass 6% this year, triple their target and more than in the November outlook.

Business confidence was little changed in January, down 1 point to 39%, according to a survey by Lloyds Banking Group Plc. It found a record portion of companies planning to raise the cost of the goods and services they sell.

“Businesses remain cautious about the pandemic and are facing into challenges from rising cost pressures, said Hann-Ju Ho, senior economist at Lloyds. “Many are raising their prices.”

Investors are betting the BOE will respond by lifting the key rate to 1% by June, the threshold where policy makers have said they’d consider selling assets -- a so-called quantitative tightening that would mirror the purchases they’ve made for more than a decade to keep a lid on market interest rates.

If the BOE’s latest outlook shows inflation at or near 2% at the end of their horizon, that may be read as a tacit endorsement of a rapid hiking cycle -- one that will rank as one of the most aggressive in the central bank’s independent history.

A hawkish tone could also see economists, who are far more cautious than investors on the outlook for hikes, reconsider their own outlook. Economists are currently seeing the BOE’s key rate at 0.75% in December, half the level priced into markets by investors.

READ MORE: Goldman Makes Aggressive Call on BOE Seeing Rates at 1% by May

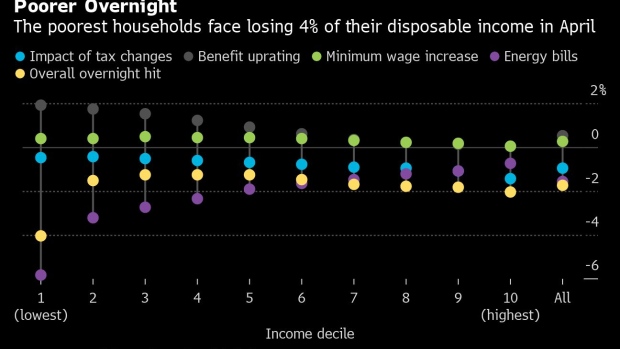

The BOE is moving at a delicate time, with attention growing on a cost-of-living squeeze set to hit households and Prime Minister Boris Johnson fighting for his political life. Energy bills are due to hit consumers hard starting in April, and the government is under pressure to back off a swinging tax increases scheduled to take effect at the same time.

The Governor hinted earlier this month that the crisis could bring down inflation on its own in the longer term by depressing demand and causing a rise in unemployment as people have less money in their pockets to spend.

“An emphasis on the cost-of-living squeeze next week might act as a device to push back on expectations for another hike in March or May,” Allan Monks, an economist at JPMorgan in London, wrote in a note to clients. “A greater emphasis on second-round effects from inflation would probably signal the need for further tightening.”

The problem for Bailey is that no amount of hiking from the BOE will take the sting out of that short-term crisis. If anything, the immediate impact of tightening will make it even worse.

Read More: The U.K. Is Two Months Away From a Brutal Cost-of-Living Crisis

Still, for now the BOE is leading other central banks in tightening, last month delivering the first hike from a major central bank since the pandemic. The signs are that others will now join. The U.S. Federal Reserve last week appeared to signal it could move as often as every meeting this year.

“The more the Fed front-loads its tightening, the less other central banks need to tighten,” said Fabrice Montagne, the chief U.K. economist at Barclays Plc. “Much of the inflationary pressure originates in U.S. excess demand for durable goods.”

©2022 Bloomberg L.P.