Oct 13, 2022

BOJ Tightens Grip on Market as 10-Year Bond Ownership Nears 70%

, Bloomberg News

(Bloomberg) -- The Bank of Japan has now boosted its ownership of the nation’s 10-year bonds to almost 70% in its efforts to cap yields, further threatening already dwindling liquidity.

The central bank increased the proportion of the 10-year securities it holds to 67% last Friday from 55% in December, data compiled by Bloomberg show. The vanishing pool of remaining debt contributed to the benchmark bond failing to trade for four days through Wednesday, the longest stretch in more than two decades.

The BOJ has stepped up debt purchases in recent months amid a selloff in global bonds. The central bank has offered to buy an unlimited quantity of debt linked to 10-year futures every day since June, and has said it will acquire more than 2 trillion yen ($13.6 billion) of five-to-10-year securities each month from October through December.

“The BOJ’s yield-curve control and the policy to cap 10-year yields at 0.25% through fixed-rate unlimited purchases are bringing down liquidity amid expectations of rising global yields,” said Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities Co. in Tokyo. “Market players would have incentive to trade only if they can see 10-year yields falling from 0.25%.”

The benchmark bond traded for the first time in a week on Thursday about six hours after the market opened. The yield held at 0.245%, just below the upper end of the BOJ’s accepted range.

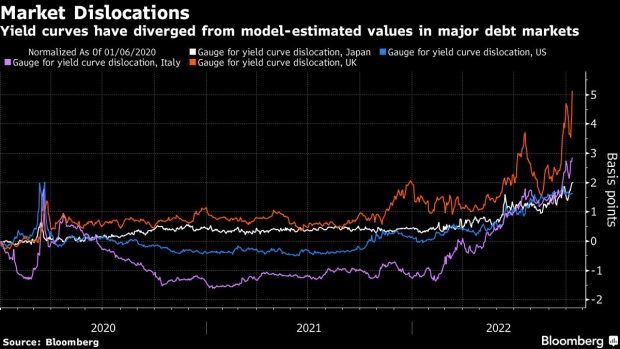

Japan isn’t the only bond market that’s seeing trading levels shrink. Thinning liquidity driven by concern about accelerating inflation and central bank interest-rate hikes is also leading to a distortion of yield curves in the US, UK and Italy.

The BOJ is trying to address the issue of shrinking liquidity by making it easier for traders to borrow cheapest-to-deliver securities. This allows more investors to get their hands on the securities, which are typically used in arbitrage trades between cash bonds and futures.

In the long-run though, only a loosening of the BOJ’s grip over the bond market will lead to a sustainable improvement in trading levels. The central bank may give the market some evidence of its long-term intentions in its next policy decision on Oct 28, when it will also release updated forecasts for inflation and growth.

Read More: Treasuries Liquidity Problem Exposes Fed to ‘Biggest Nightmare’

“Speculation of a tweak to yield-curve control may increase again among foreign investors heading into the BOJ’s policy meeting this month,” Chotaro Morita, chief rates strategist at SMBC Nikko Securities Inc. in Tokyo, wrote in a research note. “Japan’s bonds could experience large price swings again amid thin liquidity.”

The Bloomberg calculations for the amount of 10-year bonds owned by the BOJ are based on data for those 10-year securities that underlie 10-year futures. About 28% of 10-year bonds were originally linked to the futures, based on Bloomberg calculations. The BOJ also owns 10-year bonds not linked to futures.

©2022 Bloomberg L.P.