Apr 30, 2022

Charting the Global Economy: Growth in Euro Area Weakens

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Economic growth in Europe slowed at the start of the year, raising concerns about the pandemic recovery that will face additional strain from Russia’s war in Ukraine.

The euro area expanded just 0.2% in the first quarter, hurt by a contraction in Italy, stagnation in France and weaker-than-expected growth in Spain. Activity also shrank in Sweden.

It did in the U.S. as well, though that reflected a surge in imports tied to steady consumer demand.

Meanwhile, inflation in U.S., Europe, India and Brazil is pressuring central banks to tighten policy aggressively.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Europe

The euro zone’s recovery from the pandemic is already showing signs of flagging even before approaching economic storm clouds. The danger of a recession loomed into view this week after Russia halted gas flows to Poland and Bulgaria, offering a foretaste of what the region might have in store. The euro area grew only 0.2% in the first quarter.

Euro-area inflation climbed to a fresh all-time high, raising pressure on the European Central Bank to remove crisis-era stimulus and lift interest rates.

Sweden’s economy contracted in the first three months of the year as inflation started to gnaw away at consumers’ spending power and as Russia’s war against Ukraine dented sentiment.

World

China’s stringent rules to curb Covid-19 are about to unleash another wave of summer chaos on supply chains between Asia, the U.S. and Europe. Shipping congestion at Chinese ports, combined with Russia’s war in Ukraine, risks a one-two punch that threatens to derail the recovery, already buffeted by inflation pressures and headwinds to growth.

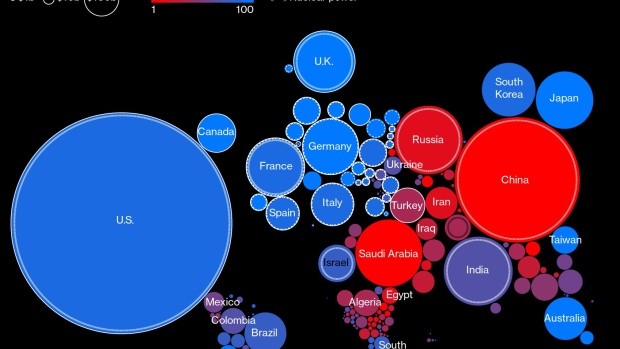

The economic and budgetary benefits of lower military spending enjoyed by the West since the end of the Cold War look set to dwindle as Russia’s invasion of Ukraine forces the focus back on to defense from Berlin to Washington.

The world’s addiction to coal, a fuel many thought would soon be on the way out, is now stronger than ever. Russia’s invasion of Ukraine turbocharged the market, setting off a domino effect that’s leaving power producers scrambling for supply and pushing prices to record levels.

U.S.

The U.S. economy shrank for the first time since 2020, reflecting an import surge tied to steady growth in consumer demand. The report is more an illustration of how GDP calculations tend to be volatile from quarter to quarter, not necessarily indicating weakness in the economy or a sign of recession.

Accelerating labor costs and a resilient consumer are fanning inflation, effectively giving the Federal Reserve the green light to raise interest rates a half point next week to tamp down price pressures. First-quarter employment costs rose by the most in comparable data back to the early 2000s and inflation-adjusted spending unexpectedly increased last month.

Asia

Core inflation in Singapore accelerated faster than expected to the highest in a decade, in sync with the central bank’s projections that price growth may worsen before it gets better on geopolitical shocks and supply-chain backlogs.

Indonesia’s shock move to ban exports of cooking oil will reverberate across the world, threatening to push up costs for the likes of Nestle SA and Unilever Plc and heightening concerns about food inflation.

Emerging Markets

Brazil’s consumer prices rose less than forecast though still posted the biggest mid-month increase in nearly two decades, keeping alive chances of an additional interest-rate hike after next week’s policy meeting.

Economists have brought forward their calls for India to increase its main interest rate in the current quarter to fight inflationary pressures made worse by war-induced supply-chain disruptions.

©2022 Bloomberg L.P.