Sep 13, 2022

China Biotech Rout Shows Growing Pain From US Decoupling Drive

, Bloomberg News

(Bloomberg) -- The latest US effort to reduce reliance on China is striking hard at the Asian nation’s biotech stocks, as investors price in more indications of decoupling between the world’s two biggest economies.

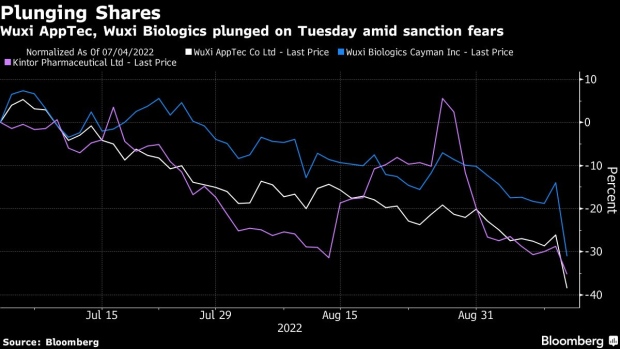

Following US President Joe Biden’s executive order to bolster domestic bio-manufacturing and cut reliance on foreign companies, bellwether Chinese stocks such as Wuxi Biologics Cayman Inc. and WuXi AppTec Co. tumbled at least 16% Tuesday in Hong Kong.

Read More: Biden Signs Order to Boost Biomanufacturing, Compete with China

Coming on the heels of US export curbs of advanced chips to China, the latest Biden order underlines stiffening strategic competition between the two nations and adds to the selling pressure on Chinese stocks. With the Asian nation also manufacturing a host of industrial and high-tech products, there are questions over what other sectors may be affected next.

“I think market hasn’t fully priced in such a risk of Sino-US conflicts. That’s why healthcare firms are plunging today,” said Paul Pong, managing director at Pegasus Fund Managers Ltd. “Competition between China and the US in areas including aerospace, AI manufacturing remains fierce and it wouldn’t surprising to see sanctions by US.”

Pharmaron Beijing Co., Asymchem Laboratories Tianjin Co. and WuXi AppTec were the worst performers on China’s CSI 300 Index Tuesday, falling at least 10% each. The benchmark gauge closed up 0.4%. In Hong Kong, Wuxi Biologics tumbled nearly 20%, the biggest drag on the Hang Seng Index.

The Biden administration has been looking for ways to curb investment in China’s industries as the Asian nation ascends as a superpower in advanced technology. Meantime, China has been relentless in its pursuit for tech supremacy, with President Xi Jinping last week renewing calls to step up development.

And defying investor expectations of an improvement from the Trump administration days, tension has remained high with a number of thorny issues unresolved.

Earlier this month, the Biden administration said it will allow Trump-era tariffs on hundreds of billions of dollars of Chinese merchandise imports to continue while it reviews the need for the duties.

The key question facing traders now is which sector will be the next to be targeted by American officials.

The US “could move the sanctions down along the supply chain in the areas that’s already sanctioned, such as semiconductor and biotech segments,” said Dai Ming, Shanghai-based fund manager at Huichen Asset Management. It may also target areas that may threaten US position, such as new energy and AI-related industries, he said.

Any additional sanctions or export restrictions by the US, China’s largest trade partner, will deal a blow to stocks at a time when the economic outlook is under pressure from Beijing’s zero Covid pursuit.

The Hang Seng China Enterprises Index, a benchmark of Chinese firms trading in Hong Kong, is down more than 19% this year, one of the worst performers among major equity indexes worldwide.

Further US actions are likely to hit tech stocks particularly hard, deepening woes in a sector that saw more than a year of Beijing’s crackdown and faces the risk of being removed from US exchanges.

“I think the tension between the two countries stays and there is a lack of trust about each other’s intention and grand strategies,” said Redmond Wong, a strategist at Saxo Capital Markets.

©2022 Bloomberg L.P.