Apr 15, 2024

China Home Prices Fall as Slump Shows Few Signs of Abating

, Bloomberg News

(Bloomberg) -- China’s home prices continued to fall in March, adding pressure on authorities to step up efforts to support the embattled real estate market.

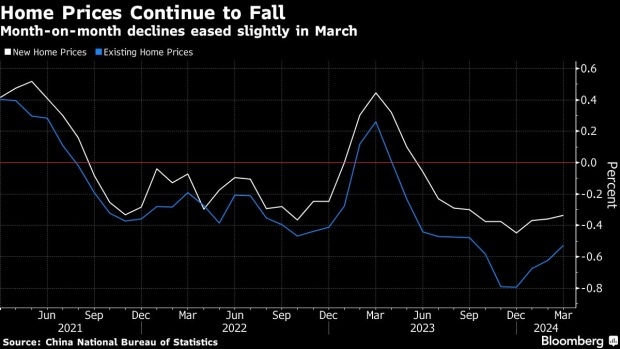

Price declines deepened from a year earlier for both new and used homes, even as they eased slightly on a month-on-month basis, National Bureau of Statistics figures showed Tuesday.

China’s years-long housing slump has yet to reach a bottom, according to Goldman Sachs Group Inc., even as policymakers ramp up measures to revive demand and alleviate debt strains among developers. Worries over home values, unfinished apartments and an uncertain economic outlook are keeping buyers at bay, dashing hopes for a rebound during the traditional spring busy season.

New-home prices in 70 cities, excluding state-subsidized housing, fell 2.7% in March from a year earlier, steeper than February’s 1.9% drop, the statistics bureau said. They slid 0.34% from February, when they retreated 0.36%.

Existing-home prices dropped 5.9% year on year, worsening from 5.2% in January and falling in all 70 cities. They declined 0.53% month-on-month, improving from a 0.62% decrease in February.

Property remains one of the biggest drags on China’s economic growth. A decline of real estate development investment widened to 9.5% in the first quarter from 9% in the first two months, the bureau said.

Read more: Chinese Economy’s Strong Start to 2024 Is Already Fading

Lukewarm price prospects have weighed on residential sales, which fell 30.7% last quarter from a year earlier. Cash amassed by property developers shrank 26%.

The latest developer to be embroiled in the housing downturn is state-backed China Vanke Co., which has seen its bonds, shares and credit ratings tumble on concerns about its finances. The builder is preparing an asset package totaling about 130 billion yuan ($18 billion) to use as collateral as it seeks new bank loans, people familiar with the matter said.

China’s top leadership has grown increasingly alarmed about the property crisis and the sluggish economy. A number of state banks are making their strongest effort yet to encourage credit officers to approve loans for developers, Bloomberg reported last week.

Private developers face a 4 trillion yuan funding gap to complete pre-sold homes, Goldman Sachs analysts wrote this week.

(Updates with sales and investment changes in the sixth and seventh paragraphs.)

©2024 Bloomberg L.P.