Feb 13, 2023

China’s Economic Bonanza From Record Trade Surplus Is Fading

, Bloomberg News

(Bloomberg) -- China may lose a key support for economic growth and the yuan this year as residents flock overseas again and exports continue to plummet because of a global slowdown.

After hitting a 14-year high of almost $420 billion last year, the surplus on the current account — the broadest measure of trade in goods and services — is expected to narrow sharply this year. Economists surveyed by Bloomberg predict it will weaken to 1.4% of gross domestic product this year, down from 2.3% in 2022.

The slump will not only affect economic growth, it will also put pressure on the currency to depreciate. Fewer exports mean less foreign income for the country, while a surge in outbound tourism means more Chinese people will be swapping their yuan for foreign currency, resulting in more outflows.

The strength of China’s exports during the pandemic was one of the key supports for the economy and the current account. Record exports of goods and an all-time high trade balance last year helped to offset the housing slump and the impact from Covid Zero restrictions.

With the export sector providing more than 180 million jobs, the slowdown in trade this year will dampen business and household income and add to the challenges China faces in expanding domestic demand.

“It’s highly likely that China will see a trade deficit in 2023, dragging down GDP growth and depressing profits and employment in the manufacturing sector,” said Dan Wang, chief economist of Hang Seng Bank China. A reversal in the trade balance will also affect expectations for the Chinese currency, increasing the volatility of yuan-denominated assets, she said.

Growth Drag

Trade in goods and services added 0.5 percentage points to GDP growth last year, taking the total expansion in the economy for the year to 3%. Trade hasn’t been a drag on growth since 2018 when the trade war with the US broke out, according to data from the National Bureau of Statistics.

Wang Tao, chief China economist at UBS Group AG, predicts net exports of goods and services could subtract about half of a percentage point from GDP growth this year, compared with her estimated addition of 1 percentage point last year. Wang said she calculates the contribution differently to the government.

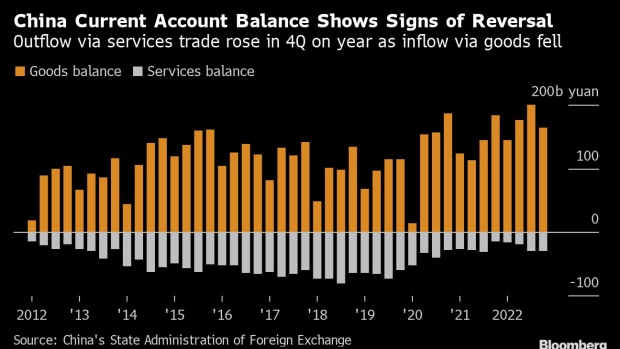

The trade picture had already started to weaken since late last year, with the goods surplus down 10% in October-December from a year ago. That was the first decline in four quarters, according to Bloomberg calculations based on data from the State Administration of Foreign Exchange.

On the services side, the trade deficit surged 89% in the final quarter of 2022 from a year ago, the first time it’s widened since the end of 2018. Even though the size of the deficit is still less than half of pre-pandemic levels, a further deterioration is likely as Chinese people travel overseas. Purchases of foreign-currency for services trade jumped in December to the highest level since March 2020.

Yuan Pressure

A strong economic rebound would also boost imports, putting pressure on the current account surplus and the yuan as more foreign currency flows out of the country. Even though financial markets have rallied on optimism about China’s recovery, the outlook remains uncertain.

“If China’s recovery falls short of people’s expectations or some financial risks escalate, overseas investors will shy away from yuan assets,” said Le Xia, chief Asia economist at Banco Bilbao Vizcaya Argentaria SA. Investors will also become more reluctant to diversify their portfolio toward emerging markets including China if the Federal Reserve continues to hike rates, he added.

Officials have sought to downplay growth concerns and instead highlighted improving confidence in the economy. Guo Shuqing, Communist Party secretary of the People’s Bank of China, said last month that economic growth will return to its normal path “rather quickly” and the yuan will continue appreciating in the mid to long term.

“I do not think a smaller surplus would be a worry for the government if that reflects stronger domestic demand,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. “That said, the government may continue to encourage inbound foreign investment, including FDI and portfolio investment, partly to prevent decoupling from western economies.”

©2023 Bloomberg L.P.