Jul 29, 2022

China’s Politburo Ignites Talk About $220 Billion More in Debt

, Bloomberg News

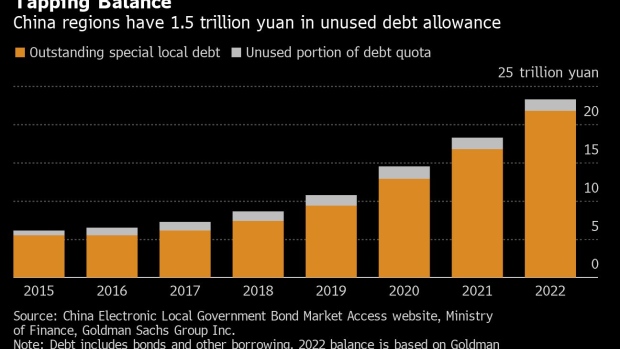

(Bloomberg) -- China’s local governments may have more money to spend this year after the nation’s top leaders urged better use of the existing debt ceiling limit, with some analysts estimating the unused amount could be as high as 1.5 trillion yuan ($220 billion).

Provinces will be supported to “make full and better” use of the ceiling on how much special debt they can take on, the Politburo, the Communist Party’s top decision-making body, said Thursday. The debt is mostly comprised of special local government bonds and is mainly used to pay for infrastructure spending, an area China is relying on to drive its Covid and property crisis-hit economy this year.

READ: China’s Politburo Signals No Big Stimulus Despite Slowdown

At the end of this year the debt ceiling will be 21.8 trillion yuan, according to the Ministry of Finance budget. However, the local authorities will only have an estimated 20.4 trillion yuan in outstanding special debt by then, Goldman Sachs Group Inc. analysts including Maggie Wei wrote in a note. That could imply up to 1.5 trillion yuan in special debt and bonds that provinces could still sell this year, the analysts wrote.

Such an arrangement could be approved in August, Ming Ming, chief economist at Citic Securities Co., wrote in a note Friday. “More developed regions may be favored if new bonds are allowed to be issued, because local financial health and project pipeline are the main considerations for allocation,” he said.

The Politburo urged economically-strong regions to take the leading role in bolstering economic growth in the second half of the year, according to a statement after the Thursday meeting which set out economic policies for the rest of the year. They should “strive to achieve their individual economic and social development goals,” the Politburo said, even as it downplayed the national annual growth target of around 5.5%.

In March the National People’s Congress, China’s parliament, approved 3.65 trillion yuan in a new quota of special local bonds, which is included in the limit for this year. Provinces heeded Beijing’s call to sell almost all those notes by the end of June to accelerate infrastructure investment to shore up growth. That means there is room for the market to absorb more debt supply in the second half of the year.

The issuance of unsold debt would be separate to any move to bring forward bond sales planned for 2023 to this year. Bloomberg reported earlier this month that the Ministry of Finance was considering a plan to sell another 1.5 trillion yuan of bonds from next year’s quota, citing people familiar with the discussions who asked not to be identified because they weren’t authorized to speak publicly. The ministry hasn’t commented on that report.

©2022 Bloomberg L.P.