Feb 15, 2023

China’s Xi Urged Stronger Measures to Boost Domestic Demand

, Bloomberg News

(Bloomberg) -- China is facing insufficient demand this year and the country needs “more forceful measures” to expand domestic spending, President Xi Jinping said late last year in a speech which promised more favorable policies to support private and foreign businesses.

China must give priority to the recovery and expansion of consumption in 2023, Xi said last December, according to an excerpt of a speech he gave at the Central Economic Work Conference. The excerpt was published Wednesday in the Communist Party magazine Qiushi.

It is necessary to increase the incomes of urban and rural residents, especially for low- and middle-income people who have a higher propensity to consume but have been greatly affected by the pandemic, according to the speech text. Consumer credit support should be increased in areas including new energy vehicles and elderly care services, he said.

Read more: China Calls Boosting Domestic Demand Top Economic Priority (2)

China will need to rely on domestic consumption and investment to drive any economic rebound this year, with exports weakening and housing construction still dropping due to the real-estate bust. Households have accumulated a record amount of savings during the pandemic, fanning hopes that that money will be spent on consumption, but some economists have argued that the amount of extra cash which would now likely be spent is much smaller than commonly estimated, especially as a lot of it is held by the rich who have less need to consume.

Unlike in the US and elsewhere, China didn’t provide pandemic stimulus checks and consumer subsidies that could fuel a post-pandemic recovery. The government’s support has focused mainly on helping businesses continue and thus preserving jobs, with senior officials saying repeatedly that free cash may give rise to welfare dependency and lower productivity.

However since December, many local governments have provided vouchers to people to boost spending on catering, tourism and home appliances, local media reported. Banks also extended a record amount of new loans in January as authorities prodded them to lend more to businesses.

Banks lent almost 3.5 trillion yuan ($512 billion) in new mid- and long-term loans to companies in January. That was almost triple the amount in December, although net bond financing by the government and short-term lending to households fell from a year earlier.

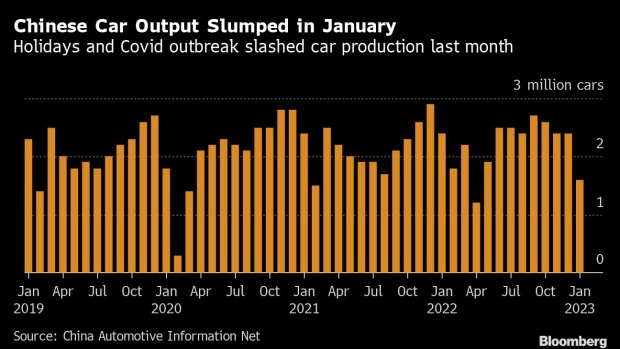

Economic data for January showed car and home sales continued to slump, while holiday consumption has yet to recover to pre-pandemic levels.

Reassuring Business

In comments that were likely meant to reassure the domestic business community, Xi said that the nation must stick to the “two unwaverings,” a phrase which meas unwavering support for both private and state-owned companies. “We must be clear and unambiguous” in our stance and stick to socialist market economic reform, Xi said, as there have been some “incorrect or even erroneous opinions” about whether China was still a socialist market economy or not.

Read more: China Private Sector Sees Big-Business Share Drop a Second Year

China should include the requirement of equal treatment for private enterprises in its laws and systems, and encourage the development of private enterprises from the perspective of policy and public opinion, according to the speech.

Amid regulatory crackdowns and a property-market slump, only about 43% of the country’s big businesses were private firms at the end of 2022, the lowest level since 2010 and down 5 percentage points from the previous year, according the Peterson Institute for International Economics, which tracked the value share of privately owned companies in the total market capitalization of China’s 100 largest listed companies back to 2010.

It’s also necessary to improve the business environment for foreign firms by promoting fair competition in the market and protect their legitimate rights, according to Xi. China “must not only retain high-quality existing foreign investment, but also attract more high-quality foreign investment,” he said.

Foreign businesses slowed down their investments in or even pulled money out of China last year as the housing slump and the government’s stringent virus controls pushed economic growth to its second-slowest pace since the 1970s. Rising geopolitical tensions added to the uncertainty, and the amount of new utilized foreign direct investment in both November and December fell more than 20% below the same months in 2021, according to data from the Ministry of Commerce.

Officials have expressed confidence that an improvement can happen, though, and in recent months announced plans to boost manufacturing investment and introduced a policy to encourage foreign businesses to set up R&D centers in China.

Xi called for efforts to prevent systemic risks caused by the real estate industry, highlighting the great significance of the industry to growth, jobs, and financial stability. All regions and relevant departments must shoulder their responsibilities and ensure the stable development of the industry, he said.

He vowed to tighten scrutiny of local governments’ implicit and explicit debts, curb the increase in hidden debts and resolve existing hidden debts. All kinds of disguised borrowing behaviors should be prohibited while the governance of financing platform companies should be strengthened, he said.

©2023 Bloomberg L.P.