Oct 19, 2022

Chinese Banks Maintain Benchmark Lending Rates as Yuan Slides

, Bloomberg News

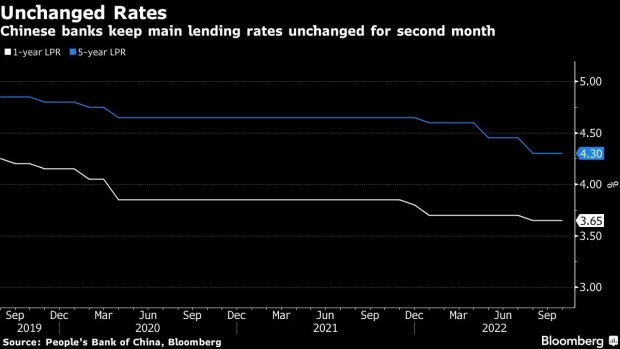

(Bloomberg) -- Chinese banks maintained their benchmark lending rates for a second month, with economists dialing down expectations for further central bank easing as the yuan continues to weaken.

The one-year loan prime rate was left at 3.65%, according to a statement by the People’s Bank of China Thursday. Fifteen of the 16 economists surveyed by Bloomberg had expected the rate to remain unchanged. The five-year rate, a reference for mortgages, was also maintained at 4.3%, in line with expectations.

The LPRs are based on the interest rates that 18 banks offer their best customers and is published by the People’s Bank of China monthly. They are quoted as a spread over the central bank’s rate on its one-year policy loans, known as the medium-term lending facility, which has been kept unchanged since a surprise reduction in August.

Investors lowered their expectations for further monetary easing in recent weeks as the yuan tumbled past 7.2 per dollar to the weakest since 2008. The PBOC may delay a cut to the reserve requirement ratio, or the share of cash banks must put in reserves, to November as the liquidity gap is small currently, the Shanghai Securities News reported this week.

More economists are also forecasting the central bank’s policy interest rates would remain unchanged by the end of this year, as the Federal Reserve’s aggressive rate hikes drive capital outflows.

“The economy still needs support from RRR and MLF rate cuts, but the chances have certainly gotten smaller given concerns over renminbi depreciation,” said Michelle Lam, Greater China economist at Societe Generale SA. “Policymakers will lean towards using fiscal policy and infrastructure stimulus to support the economy.”

The PBOC on Thursday set the daily reference rate for the yuan at the strongest bias on record versus the average estimate in a Bloomberg survey of analysts and traders, after surging Treasury yields and a selloff in US-listed Chinese equities weighed on the currency. The divergence between the Fed and the PBOC’s monetary easing stance has widened the yield gap between Treasuries and Chinese government bonds and fueled capital outflows.

What Bloomberg Economics Says ...

“We now see the PBOC delaying any cuts until the first quarter of 2023. This means prime lending rates are also likely to stay on hold for the time being, although we don’t rule out a move.”

-- Eric Zhu, economist

Click here to read the full report.

Soft credit demand suppressed by Covid and property policies is another constraint faced by the PBOC that would make the room for rate cuts more limited, according to Liu Peiqian, chief China economist at NatWest Group Plc. She forecast the MLF rate for one-year policy loans to remain unchanged for the rest of this year, though the five-year LPR may be lowered to stimulate mortgage demand if banks’ liquidity remain abundant.

Ming Ming, chief economist at Citic Securities Co., sees no change in the LPRs in the short term. The PBOC will likely rely on structural policies, provide funding support for policy banks’ infrastructure investment and lower mortgage rates directly, he said.

The PBOC’s announcement followed several unexplained delays in economic releases this week during the Communist Party’s twice-a-decade congress. The statistics office postponed the release of the third-quarter gross domestic product report a day before it was scheduled to be released on Tuesday.

(Updates with additional details.)

©2022 Bloomberg L.P.