Nov 7, 2022

Chinese Oil Imports Jump to Five-Month High on Quota Impact

, Bloomberg News

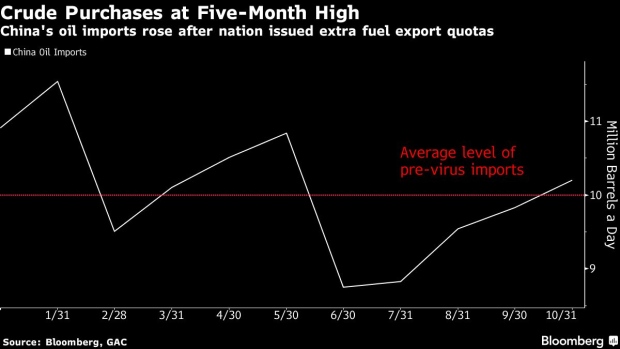

(Bloomberg) -- China stepped up oil imports last month after the government released more fuel-export quota in an attempt to help revive the country’s virus-battered economy.

The world’s biggest crude importer bought 43.14 million tons in October, according to customs data released Monday. That equates to 10.2 million barrels a day, which is 4% higher than September and the most since May.

See also: China Set for Oil Influx Just as Covid Measures Hit Demand

Beijing issued 15 million tons of fuel-export quota in late September, which can possibly be rolled over into the first quarter. The impact of the allocations will continue to show up in the crude import data for a few months, with almost 9.3 million barrels a day of oil being loaded to head to China in October, the highest since December 2021, tanker-tracking data compiled by Bloomberg show.

The extra quota and a cut in the official selling price of Saudi Arabian grades to Asia likely led to the rise in imports, Emma Li, an analyst at Vortexa Ltd. “China’s crude import growth is mostly triggered by export quota, with domestic demand still sluggish.”

See also: China’s Export Growth Unexpectedly Contracts as Demand Wanes

Despite the increase in quota, China’s net fuel exports fell 43% in October from a month earlier, separate data released Monday showed. And that was as state-owned refiners increased activity during the month, according to industry consultant OilChem. Run rates were at 76.4% of capacity on Nov. 3, the highest since April.

The October imports were slightly above the 10 million-a-day level, the pre-virus average. The drop in net fuel exports likely reflects a lag effect, as it takes refiners time to import the crude, process it into products such as diesel and gasoline, and then send it abroad.

©2022 Bloomberg L.P.