Feb 14, 2024

Cisco to cut thousands of workers after sales growth stalls

, Bloomberg News

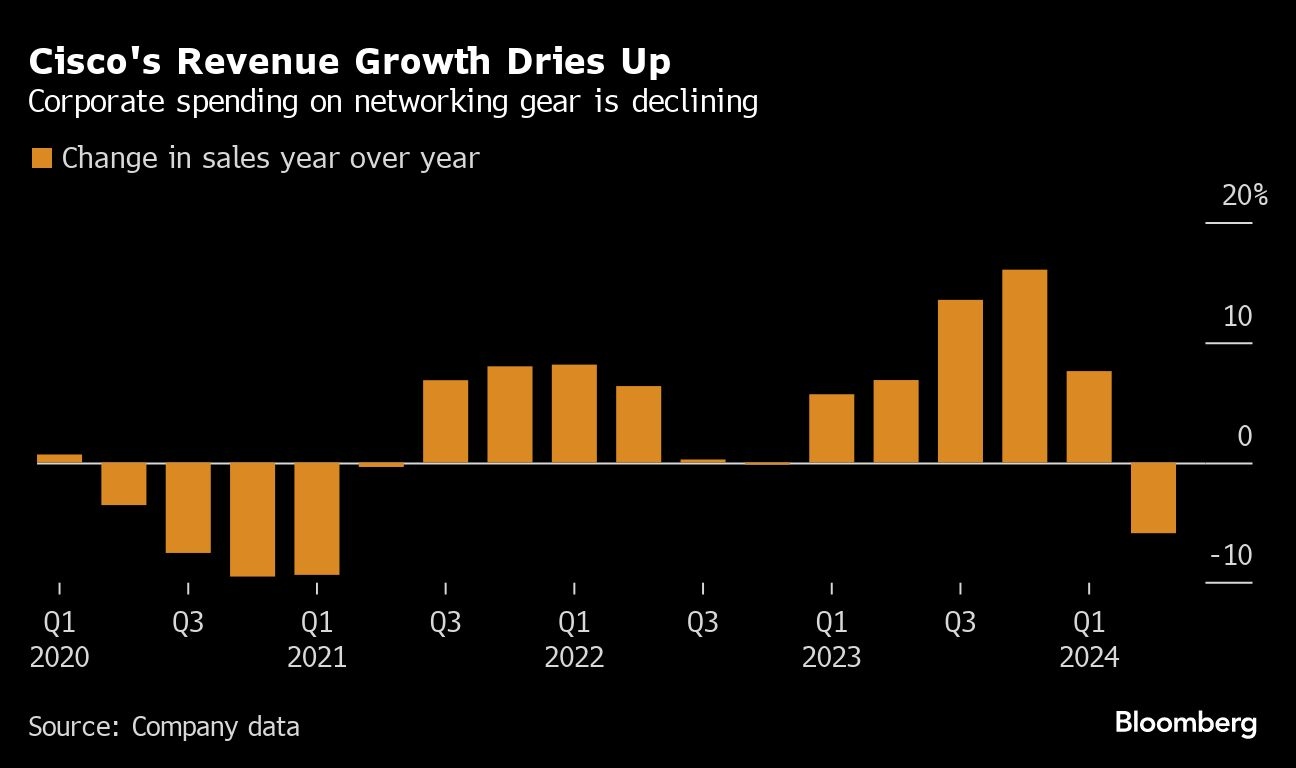

CISCO Q1: cuts full year forecast

Cisco Systems Inc., the largest maker of networking equipment, plans to cut thousands of jobs after a slowdown in corporate tech spending wiped out its sales growth.

A restructuring plan will affect roughly 5 per cent of Cisco’s workforce, the company said Wednesday. It had almost 85,000 employees as of last year, suggesting that the move will involve approximately 4,000 jobs. The restructuring will cost about US$500 million, Cisco said.

The announcement accompanied a forecast that fell far short of what Wall Street was projecting, sending Cisco shares tumbling in late trading. Customers are worried about the state of the economy, prompting them to delay orders and rethink how much equipment they may need, Chief Executive Officer Chuck Robbins told analysts on a conference call.

“Customers are pushing things out and putting a bit more scrutiny on them,” he said.

Cisco joins many of the largest tech companies in scaling back. Nearly 35,000 job cuts have been announced in 2024, according to Layoffs.fyi, which has been tracking tech layoffs since the pandemic.

Cisco shares fell as much as 6.7 per cent in late trading on the weak forecast. The shares, little changed so far in 2024, had closed at $50.28 in New York.

Sales will be $12.1 billion to $12.3 billion in the fiscal third quarter, which ends in April. That compares with an average analyst estimate of $13.1 billion. Excluding certain items, profit will be 84 cents to 86 cents a share, versus a prediction of 92 cents.

For financial year 2024, the company is now predicting a range of $51.5 billion to $52.5 billion. Earnings will be $3.68 to $3.74 a share, excluding some items. Both of those targets are below what Wall Street is projecting.

Cisco’s adjusted gross margin — the percentage of sales remaining after deducting the cost of production — is expected to be 66 per cent to 67 per cent this quarter.

In Cisco’s fiscal second quarter, which ended Jan. 27, revenue fell 6 per cent to $12.8 billion. That was the company’s first contraction in three years. Profit was 87 cents a share, minus some items. Analysts had estimated revenue of $12.7 billion and earnings of 92 cents a share.

Orders declined 12 per cent in the fiscal second quarter. And there won’t be a quick recovery in the second half as the company had previously hoped, Robbins said.

The company had said that it’s been hit by a temporary “pause” in orders from customers, who are busy installing equipment they’ve already acquired. While that supply logjam should resolve itself in the second half of the year, weak spending by telecommunications companies will likely persist longer than previously projected, Cisco said.

Robbins is trying to reduce Cisco’s sales volatility by offering more networking services — particularly analytics and security features delivered over the internet. The idea is to focus more on subscription revenue, rather than one-time sales of large networking gear. Adding to that effort, Cisco is acquiring data-crunching software maker Splunk Inc. for $28 billion, a deal announced in September.

That transaction is now on course to close as early as this quarter, Robbins said. That means Cisco is cutting jobs just as it prepares to absorb a business that had 8,000 workers as of January of last year. But Splunk has been making its own cutbacks. It announced plans to reduce its workforce by about 7 per cent in November.

Investors have been waiting to see how much Cisco will benefit from surging spending on artificial intelligence computer systems. Earlier this month, it announced it’s working with chipmaker Nvidia Corp. to help corporate clients more easily deploy AI.

Nvidia has been the biggest beneficiary of the AI spending boom, but its customers are typically large data center owners such as Microsoft Corp. and Alphabet Inc.’s Google. By combining forces, the two are hoping to spread the use of the technology. Cisco had previously said it has logged about $1 billion in AI-related orders.