Dec 18, 2023

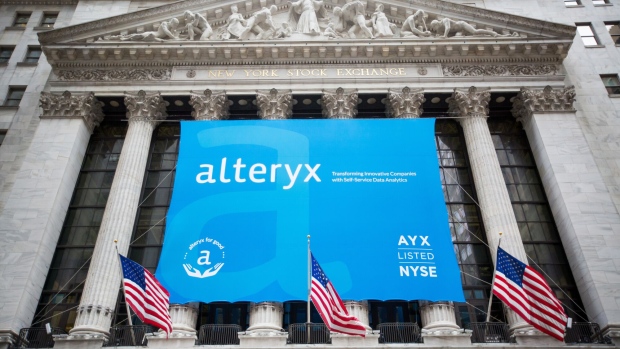

Clearlake, Insight Agree $4.4 Billion Deal to Buy Alteryx

, Bloomberg News

(Bloomberg) -- A consortium backed by Clearlake Capital and Insight Partners has agreed to buy Alteryx Inc. in a deal valuing the software developer at $4.4 billion including debt.

Alteryx shareholders will receive $48.25 in cash for every Class A or Class B common share they own, according to a statement on Monday that confirmed an earlier Bloomberg News report. Reuters had previously reported the talks.

The offer represents a 59% premium to Alteryx’s last closing price before news of a potential sale first emerged in early September. The shares closed Monday down 1.6% to $47.27.

“In addition to delivering significant and certain cash value to our stockholders, this transaction will provide increased working capital and industry expertise, and the flexibility as a private company,” Mark Anderson, chief executive officer of Alteryx, said in the statement.

Qatalyst Partners is financial adviser to Alteryx on the deal, while Houlihan Lokey Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley are working with Clearlake and Insight.

(Updates with closing share price in third paragraph.)

©2023 Bloomberg L.P.