Jul 27, 2022

Credit Suisse’s Worst Trading First-Half in Decades Augurs Cuts

, Bloomberg News

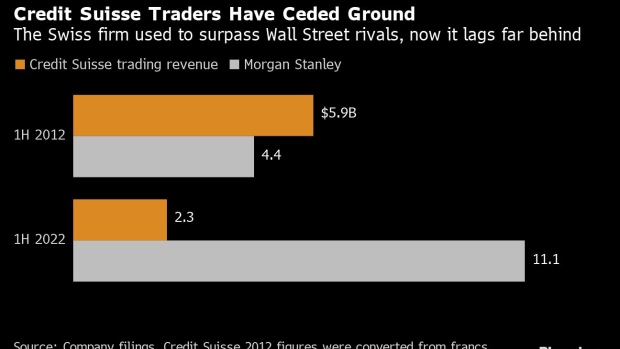

(Bloomberg) -- Credit Suisse Group AG’s traders posted their worst first-half results in more than two decades, setting the stage for an overhaul that’s likely to see the lender’s trading heft shrink further.

Revenues in both fixed income and equity sales and trading businesses were both down about a third in the second quarter, the Swiss bank said Wednesday. The trading businesses produced $2.3 billion of revenue in the first half, the lowest this century.

The results mean Ulrich Koerner, who is replacing outgoing Chief Executive Officer Thomas Gottstein, is set to accelerate an ongoing overhaul of the unit. The aim: an investment bank that uses less capital and is more tied to its wealth franchise.

“More aggressive changes are likely coming,” Bloomberg Intelligence analyst Alison Williams wrote in a note after the results. “A new plan will take time to execute, with tough markets adding risk and more detail needed.”

Credit Suisse said in a statement Wednesday that it was considering ways to fundamentally reshape the division, including attracting third-party capital for a securitized products trading business that’s typically profitable but uses about a quarter of the division’s capital.

The unit is exposed to the plunge in the value of corporate debt and securitized products amid higher interest rates. The investment bank recorded mark-to-market losses of $245 million at its leveraged finance business in the second quarter.

That focus has also seen it miss out on record activity levels in rates and FX, which have helped supercharge results at other banks. At Deutsche Bank AG, fixed-income trading rose 32% this quarter from a year earlier while the five biggest US investment banks saw similar gains.

The unit’s “positioning was not geared towards benefiting from the volatile market conditions and our areas of strength, such as capital markets, were significantly impacted,” Credit Suisse said.

Revenues from so-called macro trading -- products tied to interest rates and currencies -- surged more than 50% in the second quarter while spread products -- credit and securitized products -- slumped about 20%, according to Michael Turner, co-head of research at Coalition Greenwich. The trend is likely to continue amid fears of a recession, rising interest rates and soaring inflation, he said.

Lopsided Structure

The lopsided structure has developed over the years. Once a large Wall Street franchise, Credit Suisse emerged from a 2015 restructuring under former CEO Tidjane Thiam with a reduced trading business focused on dealing in corporate debt and securitized products.

Back then, Thiam referred to credit and securitized products as “ugly ducklings” that were unpopular because of their risks but worth it because of their profitability. They blew up just months later and lost the bank about $1 billion, however, prompting the CEO to further shrink the trading division.

Still, Credit Suisse remained focused on trading in credit and securitized products under Thiam and then Gottstein. Now the bank appears to be revisiting that assessment.

During Gottstein’s tenure, a series of scandals, such as the implosions of Archegos Capital Management and Greensill Capital, saw Credit Suisse curtail its risk taking and exit from the business of servicing hedge funds. The lender unveiled a strategy to shrink the investment bank further and shifting about $3 billion of capital to the wealth management unit.

That has seen “significant franchise erosion across all divisions, and most notably the investment bank,” Citigroup Inc. analysts said in a research note Wednesday.

Credit Suisse’s traders are unlikely to get much respite in the months ahead.

Trading so far in the third quarter “has been marked by a continued weakness in client activity, exacerbating normal seasonal declines,” the Swiss lender said Wednesday in its outlook for the investment bank. “We would expect this division to report a further loss this quarter.”

©2022 Bloomberg L.P.