Jan 25, 2024

ECB to Hold Interest Rates as Lagarde Beats Back Cut Bets

, Bloomberg News

(Bloomberg) -- The European Central Bank is set to keep borrowing costs on hold for a third meeting while stepping up efforts to convince investors that interest-rate cuts aren’t imminent.

The deposit rate will be left at 4%, according to all economists polled by Bloomberg. How long it stays there, though, is an ever-hotter topic, with President Christine Lagarde joining many of her colleagues in signaling a summer reduction is “likely.”

Officials appear to be penciling in June as the earliest juncture for monetary easing to commence, seeking in the meantime reassurance that inflation is headed back to 2%. That timetable is at odds with markets, however, which are leaning toward an initial move in April — wagers the ECB boss is almost certain to push back against once again.

Indeed, Chief Economist Philip Lane has said “important” data on wage deals will only be available for June’s meeting, and that recalibrating rates too quickly can be “self-defeating.” Citing things like the Red Sea shipping turmoil, Austrian central bank Governor Robert Holzmann has warned rate cuts can’t be taken for granted this year.

What Bloomberg Economics Says...

“The focus after the ECB’s next meeting will be on President Christine Lagarde’s words relating to interest-rate reductions in the press conference. Bloomberg Economics expects her to increase recent efforts to push back on pricing in the financial markets showing expectations for cuts to materialize by April.”

—David Powell, senior euro-area economist. Click here for full preview

Lagarde will speak at 2:45 p.m. in Frankfurt, 30 minutes after the ECB’s policy announcement.

- Follow the ECB TLIV blog here

Interest Rates

June will see the first of four 25 basis-point cuts in 2024 – taking the deposit rate to 3%— according to a separate Bloomberg survey. But forecasts differ widely, underscoring the uncertainty engulfing the outlook.

Edgar Walk, chief economist at Metzler Asset Management, anticipates 200 basis points of loosening in 2024, starting in April. His counterpart at Allianz, Ludovic Subran, foresees only two quarter-point steps, with policymakers who were criticized for underestimating the initial surge in prices wary of declaring victory prematurely now.

“The ECB will be highly reluctant to cut rates too early and too fast in order to avoid being bitten twice by inflation,” Subran said.

While markets have somewhat pared their expectations for aggressive reductions in borrowing costs, they continue to price 133 basis points of moves this year.

Some ECB officials at December’s policy meeting expressed concern that investors’ dovish pricing “threatened to loosen financial conditions excessively, which could derail the disinflationary process,” according to an account published later.

Dutch central bank Governor Klaas Knot echoed those sentiments last week, warning that excessive bets on rate reductions could actually hold back monetary easing.

Economic Backdrop

Recent data have been mixed. Surveys of purchasing managers for January signaled that a possible recession in the 20-nation euro area in the second half of 2023 could well extend into the first quarter of this year.

The labor market remains strong, though. The unemployment rate unexpectedly dipped to 6.4% in November — matching June’s record low but doing nothing to soothe worries about second-round effects.

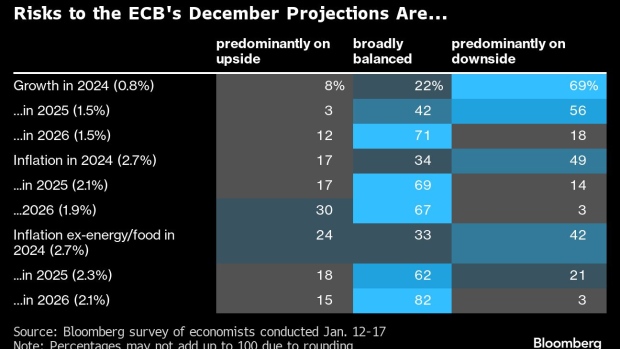

The ECB’s December outlook envisaged gross domestic product rising 0.6% in 2023, 0.8% in 2024 and 1.5% in 2025 — a more optimistic view than the consensus. In mid-January, Vice President Luis de Guindos described growth developments as “disappointing.”

Inflation, meanwhile, jumped to 2.9% from a year earlier in December from 2.4% the previous month. The uptick is considered temporary, however, with the ECB expecting further slowdown in 2024, albeit less acutely than in 2023. It continues to forecast a return to the 2% target in 2025.

Operational Framework

Lagarde may give an update on the ongoing review of the operational framework, which will determine how the ECB implements monetary policy going forward. A recent Bloomberg poll showed economists expect the results in April.

Majorities predict preferences for a smaller balance sheet and demand-driven liquidity provision, as well as a permanent bond portfolio and higher reserve requirements.

Staff Criticism

Just three days before this week’s decision, Lagarde was heavily criticized by some of her own employees and may well be quizzed on the topic.

In a staff union survey marking the halfway point of her eight-year term, a slight majority of respondents assessed her presidency as either “poor” or “very poor.” More than 53% also said Lagarde wasn’t currently the right person for the job.

The IPSO union said the results are significantly worse than those for her predecessors, Mario Draghi and Jean-Claude Trichet. The central bank called the poll “flawed.”

--With assistance from Alexander Weber, Jana Randow, Aline Oyamada and Joel Rinneby.

©2024 Bloomberg L.P.