Oct 24, 2022

Era of Negative-Yielding Debt Close to End as Japan Yields Rise

, Bloomberg News

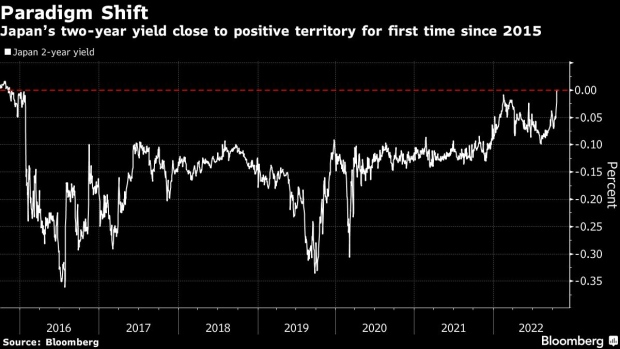

(Bloomberg) -- The era of negative-yielding global bonds looks tantalizingly close to an end with Japan’s two-year yield on the cusp of breaking above zero for the first time since 2015.

The short-dated yield climbed to minus 0.005% Monday, reflecting growing bets that the Bank of Japan may be forced to follow global peers and tighten policy as price pressures increase and the yen slumps to a 32-year low. The BOJ meets later this week and while economists see no change to policy, wagers on a tweak have ramped up this month.

Bond Vigilantes Revive Wagers on a BOJ Hawkish Policy Shift

The BOJ is the last holdout among developed central banks sticking to rock-bottom interest rates to boost the economy and its short-term policy rate remains at minus 0.1%. BOJ Governor Haruhiko Kuroda has made clear he had no intention to change policy.

One of the boldest monetary experiments of the 21st century, negative interest rates were adopted in Europe and Japan after central banks realized extreme measures were needed to boost economies still struggling years after the financial crisis. The idea was to drive borrowing costs lower and stop lenders playing it safe by hoarding cash.

But the return of sky-high inflation has meant the scrapping of the experiment, with the European Central Bank exiting negative rates in July and Denmark -- the first to go sub-zero back in 2012 -- taking its benchmark into positive territory in September. Now only Japan remains.

There, inflation has hit 3% for the first time in over three decades excluding the impact of tax hikes, an acceleration that adds to the doubts over the need for continued central bank stimulus.

The total market value of negative-yielding debt worldwide has fallen to just under $1 trillion and consists entirely of short-dated Japanese securities, according to a Bloomberg index. It peaked at over $18 trillion at the end of 2020 as central banks unleashed stimulus to deal with the coronavirus pandemic.

--With assistance from Hidenori Yamanaka.

(Updates value of negative-yielding index.)

©2022 Bloomberg L.P.