Feb 12, 2020

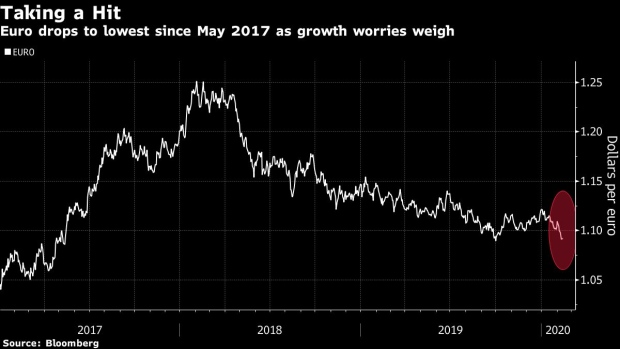

Euro Declines to Lowest Since 2017 With Economic Woes in Focus

, Bloomberg News

(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

The euro slid to its weakest level since May 2017 amid growing concern that Germany could be headed for recession because of the lingering effects on the global economy from the coronavirus.

The common currency fell as much as 0.4% to $1.0877 on Wednesday in New York. Concern about German Chancellor Angela Merkel’s succession plans and a dovish European Central Bank have weighed on the currency.

Deutsche Bank AG now expects a slight contraction for Germany in the fourth quarter. Data for Europe’s largest economy for the period are set for release Friday. While the median prediction is for 0.1% growth, almost 30% of survey respondents forecast a contraction.

“Persistently weak growth will keep pressure on the ECB to deliver further easing, posing downside risks for the euro which is already weakening in anticipation of potential policy action,” said Lee Hardman, foreign exchange strategist at MUFG Bank Ltd. in London.

Traders are dialing up expectations that the ECB may need to lower rates this year to counter the economic fallout from the coronavirus. Money markets are now pricing in almost six basis points of a cut by end-2020, versus a zero chance of easing a month earlier. Credit Agricole downgraded its forecast on the shared currency Wednesday, following similar moves by JPMorgan Chase & Co. and RBC Capital Markets last week.

Things Are Falling Apart for Europe’s Currency: John Authers

The euro area is “uniquely positioned to suffer” from the economic impact of the coronavirus, according to Mazen Issa, a senior foreign-exchange strategist at TD Securities, who recommends shorting the currency against the yen.

“The consensus view of a modest global growth rebound is, at best, delayed,” New York-based Issa wrote in a note dated Feb. 10. “In the short-term, the market is very likely to underestimate the supply chain disruptions during this viral outbreak.”

Still, with the euro down nearly 3% against the dollar so far in 2020, a majority of currency forecasters are predicting it to strengthen by the end of the year. A median of estimates in a Bloomberg survey places the euro at $1.15 by Dec. 31.

--With assistance from Edward Bolingbroke and Mark Tannenbaum.

To contact the reporters on this story: Greg Ritchie in London at gritchie10@bloomberg.net;Ruth Carson in Singapore at rliew6@bloomberg.net;Stephen Spratt in Hong Kong at sspratt3@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Shikhar Balwani, Brett Miller

©2020 Bloomberg L.P.