May 22, 2023

European Gas Prices Drop as Goldman Sees Fuel-Switching Floor

, Bloomberg News

(Bloomberg) -- European natural gas neared a two-year low as weak industrial demand and ample supplies weigh on prices, with Goldman Sachs Inc. seeing the possibility of a floor in the mid-€20 range.

Benchmark futures fell as much as 4.2% on Monday, dipping briefly below €29, to the lowest level since mid-June 2021. On Friday, the contract posted its seventh straight weekly loss, the longest such streak in six years.

Mild weather and a steady flow of liquefied natural gas have contributed to the decline as Europe recovers from its energy crisis amid severely curtailed pipeline flows from Russia. Stockpiles on the continent are now almost 66% full, well above the seasonal average, data from Gas Infrastructure Europe show.

If futures decline into the mid-€20s, gas demand could increase by 9-12 million cubic meters a day as plants switch away from coal, according to Goldman.

“This substitution process can work as a temporary floor to gas prices until industrial demand and Asia LNG imports start to improve more visibly, which in our view will ultimately pull gas prices higher into late-summer,” bank analysts led by Samantha Dart said in a research note.

German power futures for June also fell on Monday, however, removing some incentives for fuel switching. Fabian Ronningen, a power analyst at Rystad AS, said that electricity demand remains low, with recent strength in renewables helping to keep prices down.

Weather Wild Card

Weather-related issues heading into the summer remain a wild card for gas demand. Solar output in Germany on Monday is set to approach the record set last July, according to Bloomberg models. That could further reduce demand for gas in power generation.

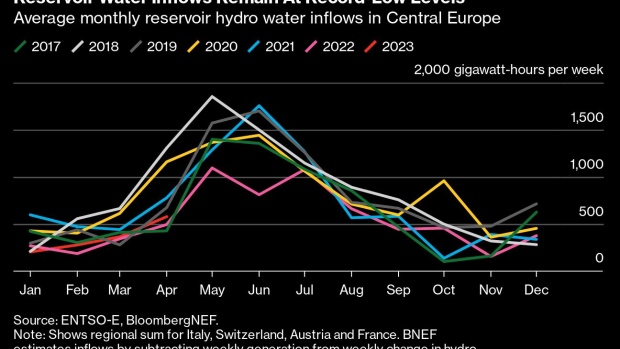

Still, last year’s drought — which dried up rivers across the continent —remains a fresh memory. Hydro reservoirs in Italy, Switzerland, Austria and France are filling up at the second-lowest rate since 2017, according to BloombergNEF. That could lead to more gas being burned for power generation, raising power prices.

Dutch front-month gas, Europe’s benchmark, declined 1.7% to €29.65 per megawatt-hour by 4:20 p.m. in Amsterdam. The UK equivalent contract fell 2.5%. German front month power declined 3.1% to €86.50 per megawatt-hour.

--With assistance from Anna Shiryaevskaya and Josefine Fokuhl.

©2023 Bloomberg L.P.