Apr 22, 2023

Fed’s Next Rate Move May Crystallize With Coming Data: Eco Week

, Bloomberg News

(Bloomberg) -- The latest US figures on growth, inflation and wages will be released in the coming week — some of the final marquee reports the Federal Reserve will have in hand before its May policy meeting.

The government will release its initial estimate of first-quarter gross domestic product, expected to show consumer spending got off to a solid start for the year. It’ll also likely confirm that inflation remains too high, particularly the core measure that excludes food and energy prices.

Fed officials will probably be more interested in monthly data when the personal consumption expenditures price index for March comes out the next day. While the headline measure may fall notably on an annual basis — it’ll be compared to March 2022, when energy prices spiked after Russia invaded Ukraine — the core figure should stay quite elevated.

Taken together with the employment cost index, which will likely show wages and benefits still rising a pace too strong to be consistent with 2% inflation, Feb policymakers will probably tilt toward another quarter-point interest-rate hike at their May 2-3 meeting.

To round out the week, data will also be released on US inflation expectations, regional manufacturing activity and consumer confidence.

What Bloomberg Economics Says:

“If underlying inflation is indeed running at a 4%-6% pace, even a peak fed funds rate of 5.25% is barely sufficient. Nonetheless, recent Fedspeak points to a shared sentiment on the FOMC that the end of the current tightening cycle is near, with a strong hint toward one last 25-bp hike at the May meeting.”

—Anna Wong, Stuart Paul, Eliza Winger, Jonathan Church, economists. For full analysis, click here

Elsewhere in North America, the Bank of Canada releases a summary of deliberations from its April 12 decision to hold rates steady at 4.5%. Governor Tiff Macklem has said his colleagues discussed the need to potentially raise rates further.

The economy there is showing surprising resilience amid higher rates, a view that will be put to the test Friday when Statistics Canada releases GDP data for February and a flash estimate for March.

The euro-zone economy probably returned to growth in the first quarter in data due the same day, while the debut decision of the Bank of Japan’s new governor will also take place on Friday.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Asia

Governor Kazuo Ueda holds his first meeting at the helm of the Bank of Japan amid intense scrutiny over how he might steer policy away from the massive easing of the past decade without upending markets.

BOJ officials are wary of tweaking or scrapping their complex stimulus framework at the gathering, according to people familiar with the matter. But market players are still on high alert in case the new leadership opts for a surprise at a time when Japan’s inflation continues to outpace expectations.

The week starts with the latest inflation figures for Singapore on Monday that are expected to show a further slowing.

South Korea is likely to narrowly miss a technical recession in GDP figures on Tuesday, an indication of how its economy has been sputtering under higher interest rates and weakening global growth.

Quarterly CPI figures are also expected to show a cooling in Australia on Wednesday, ahead of a central bank policy decision the following week.

China releases industrial profit figures on Thursday that may show an improvement from the sharp drop in January and February as the world’s second-largest economy recovers from Covid lockdowns.

Thai trade numbers and Taiwan GDP are among the data points on Friday that include a splurge of figures from Japan ahead of the BOJ decision.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

European Central Bank officials have until Wednesday to air views on a possible rate hike at the May 4 decision before the pre-meeting quiet period starts. Among policymakers due to speak are Vice President Luis de Guindos and Bank of France governor Francois Villeroy de Galhau.

Major data on Friday will inform officials wondering how far tightening should continue. It may show euro-zone growth resumed in the first quarter with a 0.2% gain in GDP as all four of its biggest economies proved resilient enough to shake off the fallout from war on the region’s frontier.

Economists reckon both Germany and Italy succeeded in eking out expansions after prior contractions, while France and Spain are expected to have kept growing.

Policymakers will need to wait until the following week for euro-zone inflation data. Hints will come on Friday, though, with consumer-price reports for April from three of the region’s biggest economies.

Headline inflation measured by European Union standards is expected by economists to have held at 7.8% in Germany and 6.7% in France, while it might even have accelerated in Spain, to 3.8%. All outcomes would be noticeably above the ECB’s 2% goal.

The major central-bank decision in the coming week will be from Sweden. The Riksbank is widely expected to raise its rate by 50 basis points, the upper end of its guidance, as inflation stays clearly above projections while the krona remains weak.

A decline in economic output and a longer-than-forecast wage agreement reached earlier this month have cooled expectations for a larger hike.

The Swiss National Bank will publish its first-quarter results and may face scrutiny at its annual general meeting in Bern on Friday.

Meanwhile, Turkish monetary officials are also expected to hold the benchmark rate at 8.5% on Thursday, though some economists don’t rule out a surprise cut. That would be a symbolic move ahead of elections in May, and after President Recep Tayyip Erdogan’s latest call for cheap lending.

The same day, Ukraine’s central bank may keep its rate unchanged at 25%. And on Friday, Russia is also expected to stay on hold despite growing inflation risks.

Looking south, data on Thursday from Zambia will probably show price growth returned to double-digits this month for the first time since May 2022, fueled by a weaker kwacha.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Mexico’s bi-weekly inflation report on Monday is the second-to-last set of readings before Banxico’s May meeting, where a rate hold may be on the table.

Argentina’s February GDP-proxy results will likely turn negative as a record drought there ruins millions of acres of corn, wheat and soybeans, the nation’s biggest exports.

Brazil’s broadest measure of inflation may slow to a five-year low, while the mid-month reading of the benchmark consumer price index could post a precipitous drop due to the base effect.

The week ends with a jam-packed Friday: Brazil posts February GDP-proxy data and March joblessness, while Chile reports six separate March indicators — manufacturing, output, retail sales among them — all of which are likely to remain negative.

Mexico’s flash GDP reading may show quarterly output picked up in the first quarter after three consecutive lower prints. Analysts in the previous central bank survey of economists marked up their 2023 growth forecast to 1.43% from 1.16% a month earlier.

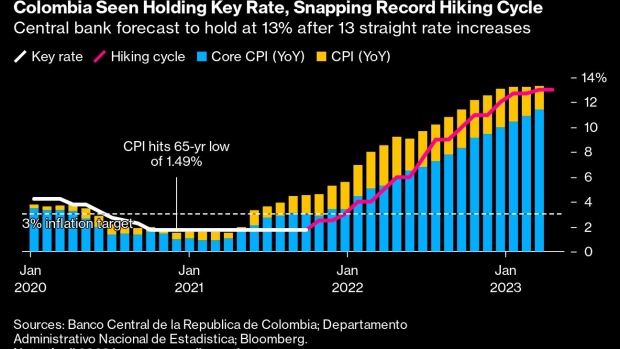

Consensus has it that Colombia’s Banco de la Republica will end a record tightening cycle by holding its key rate at 13%.

The central banks of Brazil, Chile and Peru are done hiking, and Banxico’s policymakers may follow suit in May.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Robert Jameson, Stephen Wicary, Malcolm Scott, Sylvia Westall, Andrea Dudik and Ott Ummelas.

©2023 Bloomberg L.P.