Apr 25, 2023

First Republic’s Deposit Exodus Has Analysts Most Bearish Ever

, Bloomberg News

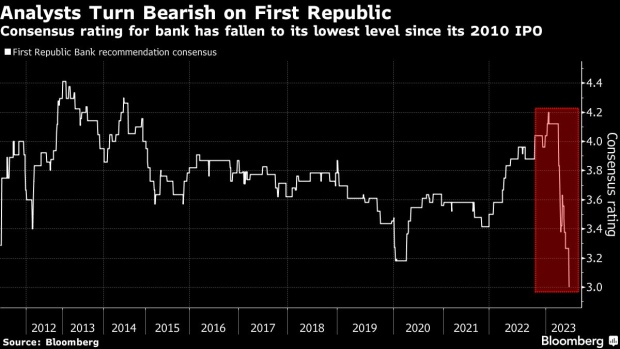

(Bloomberg) -- Wall Street analysts covering First Republic Bank have turned the most bearish on the lender since its initial public offering more than a decade ago as a plunge in deposits led to a fresh wave of downgrades and sent shares sliding to a record low.

The stock sank by as much as 51% Tuesday after its earnings report further dented confidence and a Bloomberg News report citing people with knowledge of the matter said the bank is exploring divesting $50 billion to $100 billion of long-dated mortgages and securities. Deposits plunged 41% in the quarter, prompting analysts from Citigroup Inc., Maxim Group LLC, Compass Point Research & Trading LLC and Janney Montgomery Scott LLC to downgrade their ratings.

“With still a large level of uncertainty in outcomes and expected losses beyond the next year, we recommend investors sell shares as the outlook appears largely unclear,” Citigroup’s Arren Cyganovich wrote as he cut his rating on the stock to sell.

The Tuesday downgrades took the consensus analyst rating for First Republic to the lowest level on record for the stock, according to data compiled by Bloomberg.

The San Francisco-based lender had been shaken last month by the collapse of Silicon Valley Bank. The Monday evening earnings report added to the company’s woes as the bank said it would cut as much as 25% of its workforce and executives didn’t take questions on the earnings call.

First Republic’s plunge has made it stand out even among hard-hit regional bank stocks. The stock had already tumbled 87% this year through Monday’s close, making it the worst performer in the KBW Bank Index amid the regional bank tumult. Other US lenders followed First Republic lower, with the KBW Regional Banking Index underperforming the broader S&P 500 Index.

Janney Montgomery Scott analyst Tim Coffey, who also downgraded First Republic to sell after its results, said the company is in need of a major pivot. He cut his target price to $8 from $10.

Compass Point’s David Rochester downgraded to sell from neutral and cut his target to $10 from $15, writing that he sees the stock as “challenged over the near-term, as we see downside potential as more likely and upside potential as much more limited given our expectation for FRC to begin to post quarterly losses starting in 2Q23.”

The average target price for the bank sits at roughly $38, according to data compiled by Bloomberg, but remains far above the stock’s current level of about $9, as some analysts’ targets haven’t refreshed in months.

While Maxim’s Michael Diana also downgraded shares on Tuesday — lowering his rating to hold from buy — he’s less concerned about the bank’s long-term viability.

“We do not believe that First Republic is going to fail, but it could be a long grind back to previous levels of profitability and growth, unless management can devise a shorter-term solution that is not accompanied by large dilution of common shareholders,” Diana wrote in a note to clients.

--With assistance from Felice Maranz.

(Updates to add latest trading for First Republic)

©2023 Bloomberg L.P.