Feb 3, 2023

Foreigners Buy Most Japan Equity Since 2018 as BOJ Worry Eases

, Bloomberg News

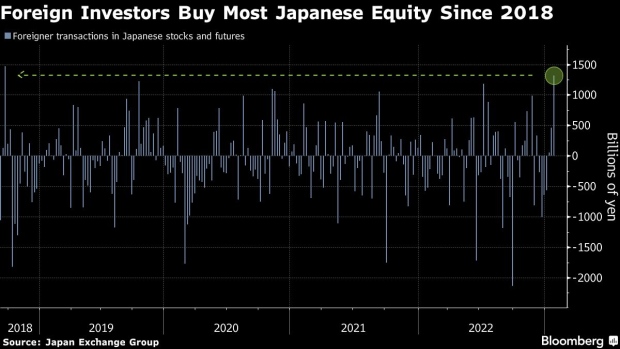

(Bloomberg) -- Foreign investors last week bought the most Japanese equity in over four years, returning to the market after heavy sales following the central bank’s surprise move in December to raise a cap on bond yields.

Overseas traders bought a net total of 1.3 trillion yen ($10.2 billion) worth of the nation’s stocks and futures in the week ended January 27, the most since September 2018, according to the latest data from Japan Exchange Group Inc.

It looks like foreign investors bought back equity after the Bank of Japan’s January decision to keep policy on hold, said Ryuta Otsuka, a strategist at Toyo Securities Co Ltd. The inflow could be short term, however, as investors that are focused on futures such as hedge funds and commodity trading advisors, “easily change their positions depending on the current market conditions,” he added.

Japan Stocks Make Full Recovery From BOJ’s Shock Yield Pivot

--With assistance from Shintaro Inkyo.

©2023 Bloomberg L.P.